5 ETF Red Flags That Scream Avoid This ETF: Warning Signs That Cost Thousands

Not all ETFs are created equal. Some hide expensive fees, others suffer from terrible liquidity, and a few are outright investment traps designed to extract maximum fees from unsuspecting investors. Learn to spot these 5 critical ETF red flags before they cost you thousands in lost returns.

Why ETF Red Flags Cost You More Than You Think

Every year, investors lose billions to problematic ETFs that display obvious warning signs—if you know what ETF red flags to look for. These aren’t subtle differences between good and great funds. These are glaring ETF red flags that signal fundamental problems: excessive costs, poor management, illiquidity, or misaligned investment strategies.

The challenge is that most investors never learn to identify ETF red flags. They chase performance, follow tips from financial media, or simply pick the first fund that matches their desired exposure. By the time they realize they own a problematic ETF, they’ve already sacrificed years of compound growth to avoidable mistakes.

This guide reveals the 5 most critical ETF red flags that should immediately send you looking elsewhere. Master these warning signs, and you’ll avoid the costly mistakes that plague inexperienced ETF investors.

Red Flag #1: Sky-High Expense Ratios Without Justification

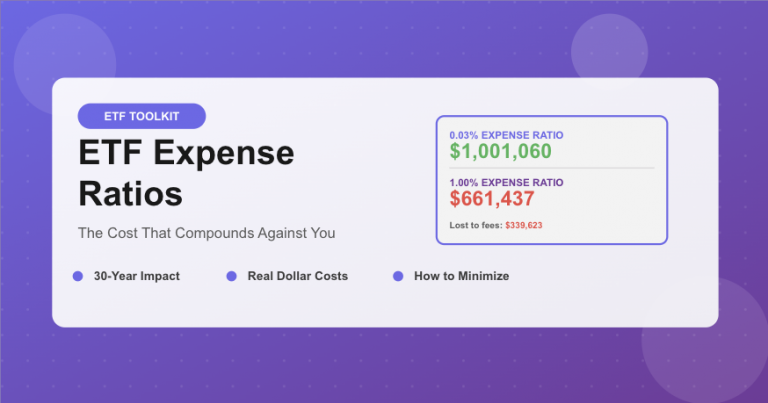

The first and most obvious ETF red flag is an excessive expense ratio relative to the fund’s strategy and complexity. This ETF red flag directly impacts your returns every single year—and the damage compounds relentlessly over time.

What Qualifies as a High Expense Ratio ETF Red Flag?

Expense ratio ETF red flags depend on the fund category. A 0.50% expense ratio might be acceptable for an actively managed international small-cap ETF but is absolutely a red flag for ETF tracking the S&P 500, where competitors charge 0.03%.

⚠️ Expense Ratio ETF Red Flag Thresholds:

Large-Cap U.S. Equity: Above 0.10% is a red flag ETF warning

International Developed: Above 0.30% raises ETF red flag concerns

Emerging Markets: Above 0.50% is a clear ETF red flag

Bond ETFs: Above 0.20% should trigger ETF red flag investigation

Actively Managed: Above 0.75% is an extreme ETF red flag

The Compound Cost of This ETF Red Flag

Here’s why high expense ratios represent such a critical ETF red flag: a seemingly small percentage difference creates massive long-term wealth destruction.

This ETF red flag cost you over $25,000 on a $10,000 investment. That’s not a rounding error—it’s retirement security destroyed by ignoring expense ratio ETF red flags.

How to Verify This ETF Red Flag

Always compare expense ratios against direct competitors. If you’re evaluating an S&P 500 ETF and discover competitors charge 0.03-0.04% while your candidate charges 0.50%, you’ve identified a massive ETF red flag. There’s no legitimate reason to pay 12x more for identical exposure.

Red Flag #2: Dangerously Low Assets Under Management (AUM)

The second critical ETF red flag is insufficient assets under management. This ETF red flag signals multiple risks: potential fund closure, poor liquidity, and unsustainable economics for the fund provider.

Why Low AUM is a Critical ETF Red Flag

When an ETF has low assets under management, it creates several problems that make this a serious ETF red flag:

Fund Closure Risk: ETF providers regularly close unprofitable funds. If your ETF shows the red flag of under $50 million in AUM after 2+ years of operation, closure risk is substantial. Fund closures force you to sell, potentially at an inopportune time and triggering unwanted capital gains taxes.

Liquidity Problems: Low AUM creates this ETF red flag scenario: wide bid-ask spreads that cost you money on every trade. You might see spreads of 0.20-0.50% instead of the 0.01-0.02% typical of large ETFs. These transaction costs quickly exceed any expense ratio savings.

Tracking Error Issues: Smaller ETFs often display the ETF red flag of higher tracking error because they can’t efficiently replicate their target index. Fixed costs represent a larger percentage of a small asset base, degrading performance.

📊 AUM ETF Red Flag Thresholds

Under $10 million: Severe ETF red flag – Closure likely within 12 months

$10-50 million: Significant ETF red flag – Monitor closely for closure announcements

$50-100 million: Moderate ETF red flag – Acceptable only for very specialized strategies

$100-500 million: Minor concern – Generally safe but watch for growth trends

Above $500 million: No red flag ETF concern regarding AUM

Exception: Brand-new ETFs from major providers (Vanguard, BlackRock, State Street) can be safe even under $100M initially, but this ETF red flag should disappear within 12-18 months as assets grow.

Real ETF Red Flag Example: Fund Closures

In 2023 alone, over 200 ETFs closed due to insufficient assets—a clear validation of this ETF red flag. Investors in these funds faced forced liquidations, unexpected tax bills, and the hassle of finding replacement investments. All of this was predictable by recognizing the low AUM ETF red flag early.

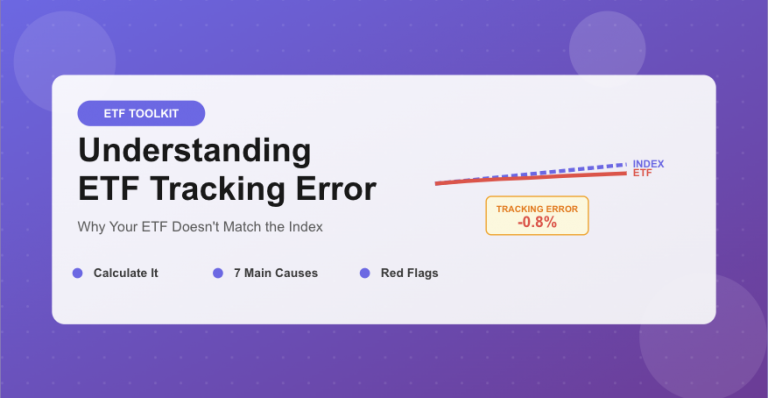

Red Flag #3: Massive Tracking Error vs Benchmark

The third critical ETF red flag is significant tracking error—when an ETF consistently fails to replicate its stated benchmark index. This ETF red flag reveals fundamental execution problems that permanently cost you returns.

Understanding Tracking Error as an ETF Red Flag

Tracking error measures how closely an ETF follows its benchmark. A small tracking error (0.05-0.15% annually) is normal and expected. But when you discover tracking error exceeding 0.50% annually, you’ve identified a serious ETF red flag that demands explanation.

This ETF red flag manifests in two forms:

Negative Tracking Error (Most Common ETF Red Flag): The ETF consistently underperforms its benchmark by more than its expense ratio. If an ETF with a 0.20% expense ratio trails its index by 0.75%, that extra 0.55% represents the ETF red flag cost of poor execution.

High Tracking Variance (Volatility Red Flag): The ETF’s returns diverge unpredictably from the benchmark—sometimes ahead, sometimes behind, but inconsistently. This ETF red flag signals you’re not actually getting the exposure you paid for.

💡 How to Check for This ETF Red Flag:

1. Compare the ETF’s 1-year, 3-year, and 5-year returns to its stated benchmark

2. Calculate the difference between ETF return and benchmark return

3. Subtract the expense ratio from this difference

4. If the remaining gap exceeds 0.30% annually, you’ve found a significant ETF red flag

5. Check if this ETF red flag persists across multiple time periods

What Causes Tracking Error ETF Red Flags?

Several factors create this ETF red flag:

Poor Replication Strategy: The fund uses sampling instead of full replication, but does it poorly. This ETF red flag appears frequently in small-cap and international ETFs where full replication is expensive.

Cash Drag: The ETF holds excessive cash positions instead of staying fully invested. This ETF red flag causes underperformance in rising markets as cash earns minimal returns.

High Portfolio Turnover: Excessive trading generates transaction costs that create this ETF red flag. Index changes shouldn’t require massive turnover in a well-managed fund.

Securities Lending Problems: While securities lending can offset costs, poorly managed programs create this ETF red flag through counterparty risk and operational inefficiencies.

Red Flag #4: Suspiciously High Yields or Returns

The fourth dangerous ETF red flag is yields or returns that seem too good to be true—because they usually are. This ETF red flag often disguises leverage, derivatives, or unsustainable distribution policies that will eventually blow up.

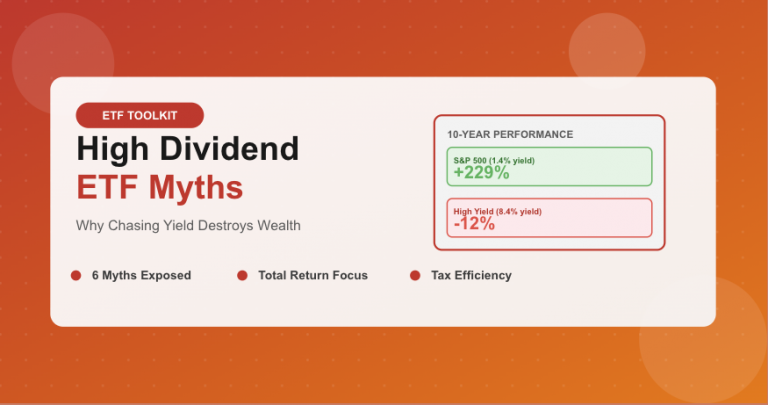

The High Yield ETF Red Flag

When you see an ETF advertising a 12% yield while similar funds yield 4-5%, you’ve discovered a massive ETF red flag. These “high yield” ETF red flags typically involve:

Return of Capital Distributions: The ETF isn’t actually earning that yield—it’s returning your own money as “distributions.” This ETF red flag means you’re paying taxes on your own capital while the fund’s NAV slowly erodes. Check the fund’s distribution breakdown: if “return of capital” exceeds 20%, you’ve identified this ETF red flag.

Covered Call Strategies: Some ETFs generate high income by selling call options, sacrificing upside potential. This ETF red flag produces high current income but caps your gains. In bull markets, these funds dramatically underperform, turning today’s “high yield” into tomorrow’s regret.

Leverage Amplification: Leveraged and inverse ETFs create the illusion of superior returns but hide massive risks. A 2x leveraged S&P 500 ETF showing 30% returns might seem attractive until you understand the ETF red flag: leverage decay means it won’t deliver 2x the long-term performance. These products lose money over time even if the underlying index rises.

🚨 Critical Warning on Leveraged ETF Red Flags:

Leveraged and inverse ETFs (2x, 3x, -1x, -2x) represent an extreme ETF red flag for long-term investors. These products reset daily, causing “volatility decay” that destroys value over time. A study found that over 1,000+ day periods, leveraged ETFs lost 40-60% of their value even when the underlying index was flat. This ETF red flag means these products are trading tools only—never long-term investments.

The Suspiciously Strong Performance ETF Red Flag

Another version of this ETF red flag: recent performance that dramatically outpaces peer funds without clear explanation. If one S&P 500 ETF returned 35% last year while all others returned 26%, this ETF red flag demands investigation.

Possible causes of this ETF red flag:

Cherry-Picked Performance Dates: Marketing materials showing returns from a strategically chosen start date. This ETF red flag disappears when you examine full market cycles.

Backtest vs Live Performance: Newly launched ETFs showing “model” or “hypothetical” performance. This ETF red flag means the displayed returns are backtests, not actual trading results. Backtests systematically overstate real-world performance.

Survivorship Bias: The fund changed strategy or holdings after poor performance, effectively creating a new fund with a conveniently cleansed history. This ETF red flag is harder to detect but appears in funds with dramatic strategy shifts mid-life.

Red Flag #5: Misleading Fund Names and Mismatched Holdings

The fifth and perhaps most insidious ETF red flag is a disconnect between the fund’s name, stated objective, and actual holdings. This ETF red flag causes investors to unknowingly build portfolios with unintended exposures and concentrated risks.

How the Misleading Name ETF Red Flag Works

Fund naming conventions often create this ETF red flag by implying diversification or exposure that doesn’t exist. Examples of this ETF red flag include:

“Global” Funds That Are 70% U.S.: You buy a “Global Technology ETF” expecting worldwide diversification, but this ETF red flag reveals 70% U.S. concentration. You thought you were diversifying away from U.S. exposure but instead added more.

“Dividend” Funds With Minimal Yield: A fund marketed as a dividend ETF yielding just 1.5%—barely above the S&P 500. This ETF red flag means you’re paying extra expenses for negligible additional income.

“Equal Weight” Funds That Aren’t: The name suggests equal weighting, but this ETF red flag investigation reveals quarterly rebalancing means holdings drift significantly between rebalances, creating unequal weights most of the time.

“Low Volatility” Funds With High Beta: Marketed as defensive, but actual holdings show beta above 0.9. This ETF red flag means the fund won’t protect you in market downturns as expected.

📊 Real ETF Red Flag Example: EAFE Confusion

Many investors buy “International Developed Markets” ETFs expecting true global diversification. But this ETF red flag hides in the details: these funds specifically exclude the United States and Canada—they’re not “international” relative to U.S. investors; they’re “ex-North America developed markets.”

Even more surprising, these funds often have 15-20% Japan concentration. If you already own Japanese stocks elsewhere, you’ve unknowingly created concentrated risk by missing this ETF red flag in the holdings disclosure.

Always read the prospectus and holdings list, not just the marketing name. This prevents the misleading name ETF red flag from destroying your intended portfolio allocation.

How to Spot the Mismatched Holdings ETF Red Flag

Detecting this ETF red flag requires digging into the actual holdings:

Step 1: Download the full holdings list from the fund provider

Step 2: Check the top 10 holdings—do they match your expectations based on the fund name?

Step 3: Review geographic and sector allocation—does it align with the stated objective?

Step 4: Compare holdings against a direct competitor—significant differences reveal this ETF red flag

Step 5: Read the prospectus methodology—does the index construction match your assumptions?

How to Avoid ETF Red Flags: Your Action Plan

Now that you can identify these five critical ETF red flags, implement this systematic screening process before buying any ETF:

Red Flag Screening Checklist:

□ Expense Ratio Check: Compare against 3 competitors. If your ETF is 2x more expensive, investigate why or move on.

□ AUM Verification: Confirm AUM exceeds $100M (or $50M for new launches from major providers).

□ Tracking Error Analysis: Review 3-year tracking difference. If it exceeds expense ratio + 0.30%, this is an ETF red flag.

□ Yield Reality Check: If yield exceeds category average by 50%+, examine distribution composition for return of capital.

□ Holdings Alignment: Verify top 10 holdings and sector allocation match your expectations from the fund name.

Time Investment: This complete ETF red flag screening takes 10 minutes per fund. Those 10 minutes can save you years of underperformance.

When Red Flags Are Actually Yellow: Exceptions

Not every ETF red flag is absolute. Some apparent ETF red flags have legitimate explanations:

Higher Expenses for Specialized Strategies: A frontier markets or leveraged loan ETF will naturally cost more than an S&P 500 ETF. The ETF red flag isn’t the absolute expense—it’s whether expenses are competitive within the specialized category.

New Launches with Low AUM: A brand-new ETF from Vanguard or BlackRock might have low initial AUM. This ETF red flag is less concerning if: (1) it’s from a major provider, (2) it fills a legitimate market need, and (3) assets are growing month-over-month.

Intentional Concentration: Some sector ETFs are designed to be concentrated. A “Cloud Computing ETF” with top 10 holdings representing 60% isn’t necessarily an ETF red flag if that matches the fund’s explicit strategy.

The key is understanding whether the apparent ETF red flag represents a problem or simply a characteristic of the fund’s strategy.

🚨 Protect Your Portfolio

You now know the 5 critical ETF red flags that destroy returns:

High expenses, low AUM, tracking error, suspicious yields, and misleading names.

Screen every ETF against these red flags before investing a single dollar.

📈 Next in ETF Toolkit Series: Now that you can avoid problematic ETFs, we’ll tackle “ETF Tax Implications: What Your Broker Won’t Tell You”—the tax strategies that save thousands annually. Don’t miss it!