Why You Should Pay Attention to Non-Farm Payrolls – 9/30

Introduction: Why the Non-Farm Payrolls Report Demands Your Attention

As we approach the end of September 2025, investors worldwide are turning their attention to one of the most influential economic indicators: the Non-Farm Payrolls (NFP) report. Released monthly by the U.S. Bureau of Labor Statistics, this data provides crucial insights into the health of the American labor market and, by extension, the broader economy.

The NFP report measures the change in the number of employed people in the United States, excluding farm workers, government employees, private household employees, and employees of nonprofit organizations. This seemingly straightforward statistic carries enormous weight in financial markets because employment data directly influences Federal Reserve monetary policy decisions, which in turn affect interest rates, bond yields, and equity valuations.

For investors, understanding and anticipating NFP releases is not merely academic—it’s essential for protecting capital and identifying opportunities in an increasingly data-driven market environment.

Historical Impact: How NFP Data Has Moved Markets

Market Volatility and Immediate Reactions

Historical analysis reveals that NFP announcements consistently generate significant market volatility. The report’s release typically triggers immediate price adjustments across multiple asset classes, from equities and bonds to currencies and commodities.

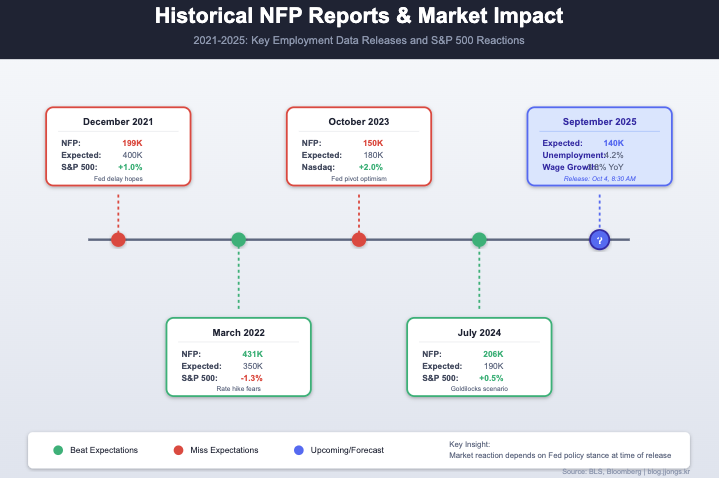

Consider the NFP release in December 2021, when the U.S. economy added only 199,000 jobs against expectations of 400,000. The disappointing figure initially sent equity futures lower as investors worried about economic momentum. However, the market quickly reversed course when traders recognized that slower job growth might delay Federal Reserve interest rate hikes, benefiting growth stocks. The S&P 500 rallied over 1% in the following trading session.

The Fed Connection and Investor Sentiment

The relationship between NFP data and Federal Reserve policy creates a complex dynamic for investor sentiment. Strong employment figures typically signal economic health, which would ordinarily be positive for stocks. However, in an environment where the Fed is fighting inflation, robust job growth can paradoxically trigger market sell-offs as investors anticipate more aggressive monetary tightening.

This inverse relationship was particularly evident throughout 2022 and early 2023. When the March 2022 NFP report showed 431,000 new jobs—well above expectations—the S&P 500 declined 1.3% as bond yields surged on expectations of faster Fed rate hikes. Technology stocks, which are particularly sensitive to interest rate changes, underperformed significantly.

Conversely, weaker-than-expected employment data has sometimes provided relief rallies, as seen in October 2023 when disappointing NFP figures of 150,000 (versus 180,000 expected) sparked optimism about a Fed pivot, lifting the Nasdaq by nearly 2% in a single day.

“Strong employment figures in an inflationary environment can paradoxically trigger market sell-offs as investors anticipate more aggressive Fed tightening.”

Sector-Specific Impacts

Different market sectors respond distinctly to NFP data. Financial sector stocks, particularly banks, often benefit from strong employment data as it suggests healthy lending conditions and economic activity. Conversely, interest-rate-sensitive sectors like utilities and real estate investment trusts (REITs) typically underperform when strong NFP data pushes yields higher.

September 2025 NFP: What Analysts Expect and How to Position

Consensus Expectations

For the September 2025 NFP report, the consensus among economists surveyed by major financial institutions stands at approximately 140,000 new jobs added. This represents a moderation from August’s figure and reflects expectations of a cooling labor market as the Federal Reserve’s cumulative rate hikes continue to work through the economy.

The unemployment rate is expected to hold steady at 4.2%, while average hourly earnings growth is projected at 0.3% month-over-month, translating to 3.8% year-over-year—a closely watched inflation indicator.

Trading Strategy Considerations

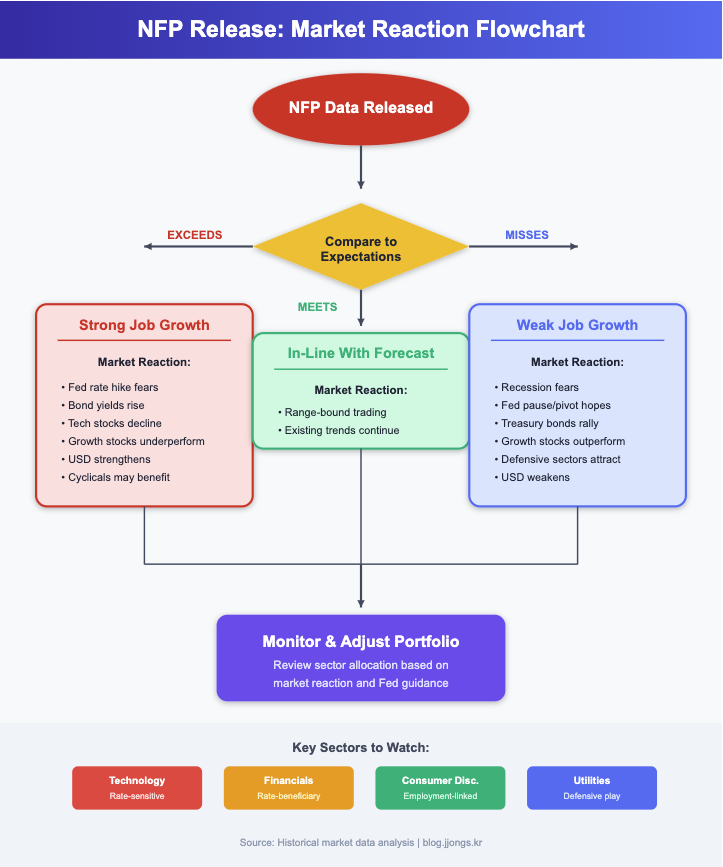

If NFP Exceeds Expectations (above 170,000):

- Expect initial downward pressure on equity markets, particularly growth and technology stocks

- Consider reducing exposure to long-duration bonds as yields will likely rise

- Cyclical sectors such as industrials and materials may show relative strength

- The U.S. dollar typically strengthens against major currencies

If NFP Misses Expectations (below 110,000):

- Anticipate a potential relief rally in equities, especially interest-rate-sensitive sectors

- Treasury bonds may rally as recession fears resurface

- Growth stocks and technology shares could outperform

- Defensive sectors like utilities and consumer staples may attract flows

If NFP Meets Expectations (130,000-150,000):

- Markets may trade range-bound with reduced volatility

- Focus shifts to other components like wage growth and labor force participation

- Existing market trends are likely to continue

💡 Quick Strategy Guide

- Beat expectations (170K+): Reduce growth stock exposure, consider financials

- Miss expectations (110K-): Add tech/growth, increase defensive positions

- Meet expectations (130-150K): Hold current allocation, watch wage data

Sectors and Stocks to Watch

Most Sensitive Sectors:

- Technology: Large-cap tech companies (Apple, Microsoft, Alphabet, Amazon) are highly sensitive to interest rate expectations

- Financials: Banks (JPMorgan Chase, Bank of America, Wells Fargo) benefit from higher rates but may suffer if recession fears mount

- Real Estate: REITs and homebuilders are particularly vulnerable to interest rate fluctuations

- Consumer Discretionary: Retail and leisure stocks reflect consumer health tied to employment

- Utilities: Dividend-paying defensive plays that move inversely to interest rates

Release Schedule and Where to Find the Data

⏰ Mark Your Calendar

September 2025 NFP Release:

📅 Friday, October 4, 2025

🕐 8:30 AM Eastern Time

📊 Expected: 140K new jobs

The September 2025 Non-Farm Payrolls report will be released on Friday, October 4, 2025, at 8:30 AM Eastern Time (ET).

Official Sources:

- U.S. Bureau of Labor Statistics: https://www.bls.gov/news.release/empsit.nr0.htm

- Federal Reserve Economic Data (FRED): https://fred.stlouisfed.org/series/PAYEMS

- Department of Labor: https://www.dol.gov/general/topic/statistics/employment

Final Thoughts

The Non-Farm Payrolls report remains one of the most market-moving data releases in the financial calendar. As we navigate the complexities of 2025’s economic landscape—balancing inflation concerns, Federal Reserve policy, and growth prospects—understanding and preparing for NFP announcements is crucial for prudent portfolio management.

Rather than attempting to predict the exact number, successful investors focus on having contingency plans for various scenarios. Consider reducing position sizes before major releases if volatility is a concern, or use options strategies to hedge directional risk while maintaining market exposure.

Above all, remember that individual NFP reports are single data points in a longer-term economic narrative. While they create short-term trading opportunities, your investment strategy should remain grounded in fundamental analysis and long-term objectives rather than reactive to every monthly release.

Stay informed, stay prepared, and trade wisely.