ISM Manufacturing PMI Alert: Critical Manufacturing Data Releasing Today – 10/1

Introduction: Why Today’s ISM Manufacturing PMI Demands Your Attention

Today at 10:00 AM Eastern Time, the Institute for Supply Management (ISM) releases one of the most closely watched economic indicators: the Manufacturing Purchasing Managers’ Index (PMI). This monthly report provides crucial insights into the health of America’s manufacturing sector and serves as a leading indicator for overall economic conditions.

The ISM Manufacturing PMI is particularly significant because it captures real-time sentiment from purchasing managers across the country—the professionals directly responsible for ordering materials, managing supply chains, and planning production. Their collective assessment offers an early warning system for economic expansion or contraction, often signaling changes in GDP growth before official government statistics are released.

With the index hovering near the critical 50-point threshold that separates expansion from contraction, today’s reading carries heightened importance for investors, policymakers, and business leaders alike. Understanding this indicator and positioning accordingly can mean the difference between capitalizing on opportunities and being caught off-guard by market shifts.

Historical Impact: How ISM PMI Data Has Moved Markets

Understanding the 50-Point Threshold

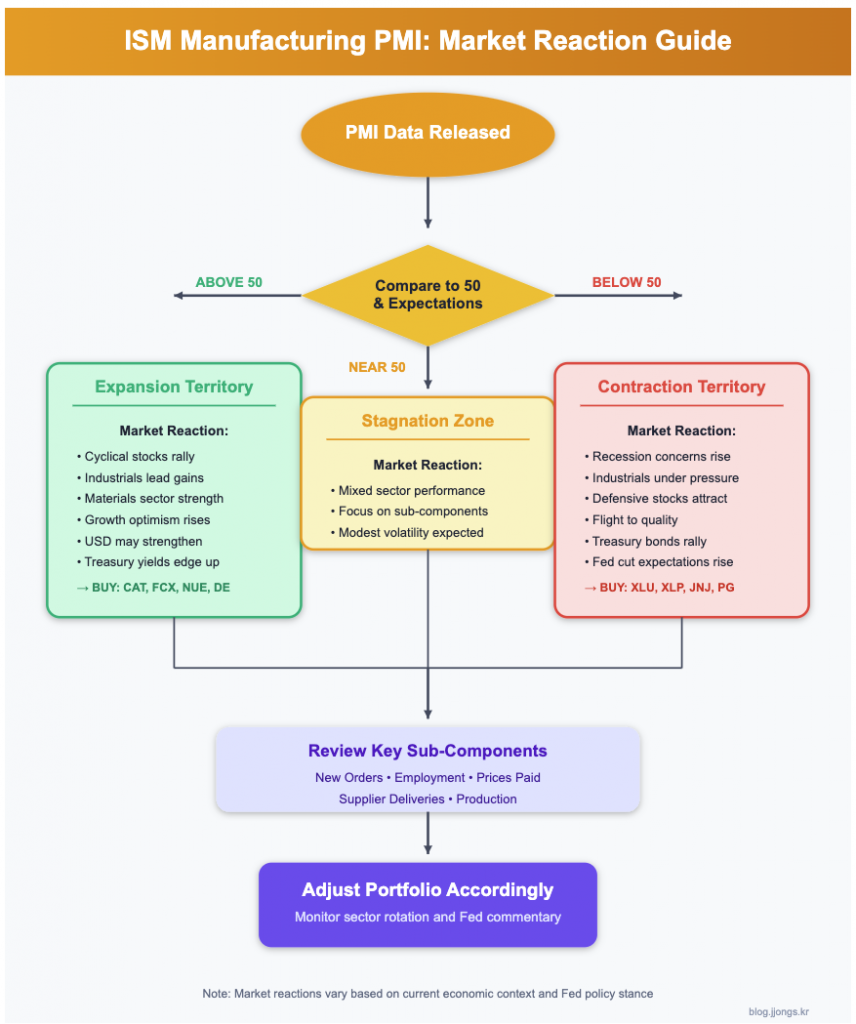

The ISM Manufacturing PMI operates on a simple but powerful scale: readings above 50 indicate expansion in manufacturing activity, while readings below 50 signal contraction. However, the market’s reaction depends not just on whether the index is above or below this threshold, but on the direction of change, the magnitude of surprise versus expectations, and the broader economic context.

Historical analysis reveals that the PMI’s predictive power extends far beyond manufacturing stocks. Because manufacturing activity is closely tied to employment, capital investment, and consumer demand, PMI movements ripple through multiple sectors and asset classes, influencing everything from industrial commodities to Treasury yields.

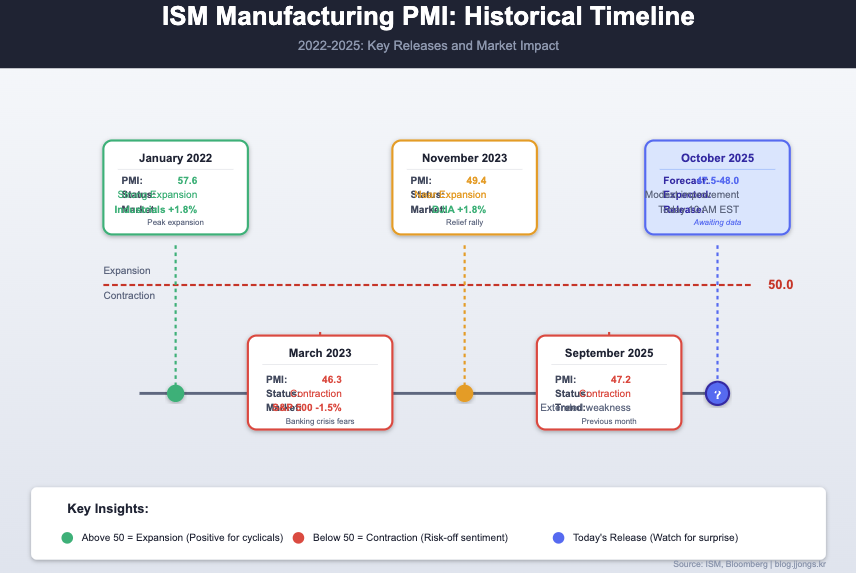

Case Study: March 2023 Banking Crisis Response

When the March 2023 ISM Manufacturing PMI came in at 46.3—significantly below the 47.5 consensus—it arrived during the regional banking crisis. The weak manufacturing data compounded recession fears, triggering a flight to safety. The S&P 500 declined 1.5% on the release, while Treasury bonds rallied sharply as investors anticipated more aggressive Federal Reserve accommodation. Technology and growth stocks particularly underperformed as the combination of banking stress and manufacturing weakness painted a picture of potential economic contraction.

Case Study: November 2023 Manufacturing Resilience

Conversely, November 2023’s surprise jump to 49.4 from 46.7—though still technically in contraction territory—sparked a powerful relief rally. The unexpectedly strong reading suggested manufacturing might be stabilizing after months of decline. The Dow Jones Industrial Average surged 1.8% that day, with industrial stocks leading gains. The improvement suggested that aggressive Fed rate hikes might not push the economy into recession, reducing tail-risk concerns that had been weighing on equity valuations.

The Fed Connection and Policy Implications

The ISM Manufacturing PMI plays a crucial role in Federal Reserve decision-making. While the Fed focuses heavily on inflation and employment data, manufacturing indicators provide essential context about economic momentum and capacity utilization. A persistently weak PMI gives the Fed more latitude to pause or reverse rate hikes, as it signals cooling demand and reduced inflationary pressure from the goods sector.

This relationship creates a complex dynamic for markets. In periods when investors fear recession, weak PMI data can paradoxically boost stock prices by increasing expectations of Fed support. However, in periods when growth is the primary concern, the same weak data can trigger sell-offs. Understanding the prevailing market narrative is essential for interpreting PMI impacts.

“Manufacturing PMI readings don’t just reflect current conditions—they shape future policy decisions and investment flows across the entire economy. The 50-point threshold acts as a psychological trigger for market reassessments of growth trajectories.”

Sector-Specific Impacts

Different sectors exhibit varying sensitivities to ISM PMI releases. Industrial stocks naturally show the highest correlation, as manufacturing health directly affects their business prospects. However, the ripple effects extend much further:

Materials and Commodities: Copper, steel, and industrial metals prices often move in tandem with PMI surprises, as manufacturing activity drives raw material demand. Mining companies and materials producers see immediate stock price reactions.

Transportation and Logistics: Railroads, trucking companies, and freight forwarders benefit from strong manufacturing activity. Companies like Union Pacific, CSX, and J.B. Hunt demonstrate high PMI correlation in their stock performance.

Technology and Semiconductors: While seemingly distant from traditional manufacturing, semiconductor companies and industrial technology firms are highly exposed to manufacturing cycles, as their products enable factory automation and production processes.

October 2025 ISM PMI: What Analysts Expect and How to Position

Consensus Expectations

For today’s October 2025 ISM Manufacturing PMI release, economists surveyed by major financial institutions forecast a reading of approximately 47.5-48.0. This represents a modest improvement from recent months but would still indicate contraction in the manufacturing sector for what would be an extended period.

The key sub-components to watch include:

- New Orders: Expected around 46.0, a critical leading indicator for future production

- Employment: Forecasted at 44.5, reflecting ongoing labor market adjustments

- Prices Paid: Anticipated at 52.0, important for inflation implications

- Supplier Deliveries: Expected near 48.0, indicating supply chain normalization

💡 Quick Strategy Guide

- Strong Beat (above 50.0): Favor cyclicals, industrials, and materials; reduce defensive positions

- In-Line (47.0-49.0): Maintain current allocation; focus on quality and earnings visibility

- Significant Miss (below 46.0): Increase defensive exposure; consider utilities, consumer staples, and quality growth

Trading Strategy Considerations

If PMI Beats Expectations (reading above 49.0):

- Industrial stocks likely to outperform; consider names like Caterpillar (CAT), Deere (DE), and 3M (MMM)

- Materials and basic resources should benefit; look at Freeport-McMoRan (FCX) and Nucor (NUE)

- Cyclical sectors such as aerospace and defense may see renewed interest

- Treasury yields may rise on reduced recession fears, pressuring rate-sensitive stocks

- The U.S. dollar could strengthen on improved growth outlook

If PMI Meets Expectations (reading 47.0-49.0):

- Markets likely to trade in range-bound fashion with modest volatility

- Focus shifts to sub-components, particularly New Orders and Prices Paid

- Selective opportunities in industrial stocks with strong order backlogs

- Quality and balance sheet strength become differentiating factors

- Existing sector trends likely to continue without major disruption

If PMI Misses Expectations (reading below 46.0):

- Flight to quality likely; favor large-cap technology and healthcare

- Defensive sectors such as utilities (XLU) and consumer staples (XLP) should outperform

- Treasury bonds may rally as recession concerns increase

- Industrial and materials stocks vulnerable to selling pressure

- Fed rate cut expectations may increase, potentially supporting growth stocks

- Consider hedging strategies or reducing equity exposure if below 45.0

Sectors and Stocks to Watch

Most Sensitive Sectors:

Industrials: This sector shows the highest direct correlation to ISM PMI movements. Key stocks include:

- Caterpillar (CAT) – Heavy machinery and construction equipment

- Boeing (BA) – Aerospace manufacturing and defense

- General Electric (GE) – Diversified industrial conglomerate

- Honeywell (HON) – Industrial technology and automation

- Deere & Company (DE) – Agricultural and construction equipment

Materials: Raw material producers and processors respond quickly to manufacturing activity changes:

- Freeport-McMoRan (FCX) – Copper and precious metals mining

- Nucor (NUE) – Steel production and metal products

- United States Steel (X) – Integrated steel manufacturer

- Dow Inc. (DOW) – Chemicals and materials science

- Newmont Corporation (NEM) – Gold and copper mining

Transportation: Freight and logistics companies benefit from increased manufacturing activity:

- Union Pacific (UNP) – Railroad freight transportation

- J.B. Hunt (JBHT) – Trucking and logistics services

- FedEx (FDX) – Package delivery and freight services

- CSX Corporation (CSX) – Rail transportation

Technology/Semiconductors: Industrial technology and chip manufacturers with manufacturing exposure:

- Applied Materials (AMAT) – Semiconductor equipment manufacturing

- Lam Research (LRCX) – Wafer fabrication equipment

- ASML (ASML) – Lithography systems for chip manufacturing

- Rockwell Automation (ROK) – Industrial automation and information

Defensive Alternatives (for weak PMI scenarios):

- Utilities Select Sector SPDR (XLU) – Defensive utility stocks

- Consumer Staples Select Sector SPDR (XLP) – Non-cyclical consumer goods

- Procter & Gamble (PG) – Consumer products giant

- Johnson & Johnson (JNJ) – Healthcare and consumer health

- Walmart (WMT) – Defensive retail exposure

Release Schedule and Where to Find the Data

⏰ Mark Your Calendar

October 2025 ISM Manufacturing PMI Release:

📅 Tuesday, October 1, 2025

🕐 10:00 AM Eastern Time (ET)

📊 Consensus Forecast: 47.5-48.0

📈 Previous Month: 47.2

Official Sources:

- Institute for Supply Management: https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/

- Federal Reserve Economic Data (FRED): https://fred.stlouisfed.org/series/MANEMP

- Trading Economics ISM PMI: https://tradingeconomics.com/united-states/manufacturing-pmi

- Bloomberg Economics: Real-time analysis and market reaction coverage

Final Thoughts

The ISM Manufacturing PMI remains one of the most reliable leading indicators of economic health, offering insights that often precede official GDP data by weeks or months. As a forward-looking measure based on actual business activity and purchasing decisions, it provides a real-time pulse of economic momentum that savvy investors cannot afford to ignore.

Today’s release takes on added significance given the ongoing debate about economic resilience, Federal Reserve policy direction, and the sustainability of equity market valuations. Whether the manufacturing sector is stabilizing or facing continued headwinds will have implications far beyond factory floors, influencing monetary policy, corporate earnings expectations, and portfolio allocation decisions across all asset classes.

Rather than attempting to predict the exact number, successful investors prepare for multiple scenarios. Consider adjusting position sizes before the release if volatility is a concern, use stop-loss orders to protect against adverse moves, or employ options strategies to hedge directional risk while maintaining market exposure.

Remember that individual PMI releases are data points in a longer-term economic narrative. While they create short-term trading opportunities and can trigger significant intraday volatility, your investment strategy should remain grounded in fundamental analysis, proper risk management, and long-term financial objectives rather than reactive to every monthly release.

Stay informed, stay disciplined, and position wisely. The manufacturing sector’s health today shapes the investment landscape of tomorrow.