ETF Expense Ratios: The Cost That Compounds Against You Over 30 Years

ETF expense ratios seem insignificant—0.50% versus 0.05% feels like pocket change. But this seemingly tiny difference compounds into devastating wealth destruction over decades. Understanding ETF expense ratios and their true long-term cost is the difference between a comfortable retirement and running out of money at age 75.

What Are ETF Expense Ratios and Why They Matter

An ETF expense ratio represents the annual fee you pay for owning an exchange-traded fund, expressed as a percentage of your investment. This ETF expense ratio covers fund management, administration, marketing, and operational costs. Unlike trading commissions you pay once, the ETF expense ratio extracts value from your account every single day you hold the fund.

The critical insight most investors miss about ETF expense ratios: these aren’t one-time costs—they compound against you year after year. A high ETF expense ratio doesn’t just reduce this year’s returns; it permanently lowers your account balance, which then has less capital to compound in future years. This creates a devastating mathematical cascade where high ETF expense ratios destroy wealth exponentially over time.

Understanding ETF expense ratios deeply—not just superficially—transforms how you evaluate funds. Once you see the true 30-year cost of a seemingly small ETF expense ratio difference, you’ll never make fund selection decisions the same way again.

How ETF Expense Ratios Work: The Mechanics

The ETF expense ratio operates invisibly. You never receive a bill or see a deduction from your account. Instead, the ETF expense ratio is deducted from the fund’s net asset value (NAV) daily. Here’s how ETF expense ratios actually work:

Daily Deduction of ETF Expense Ratios

If an ETF has a 0.50% expense ratio, the fund doesn’t wait until year-end to collect 0.50%. Instead, it deducts approximately 0.00137% every single trading day (0.50% ÷ 365 days). This daily deduction of the ETF expense ratio happens automatically before the fund calculates its daily NAV.

This is why you never “see” the ETF expense ratio as a line item on your brokerage statement. The ETF expense ratio is already reflected in the fund’s price changes. When the S&P 500 rises 1.00% and your S&P 500 ETF only shows a 0.9986% gain, that 0.0014% difference represents one day’s worth of the ETF expense ratio.

💡 Key Point on ETF Expense Ratios:

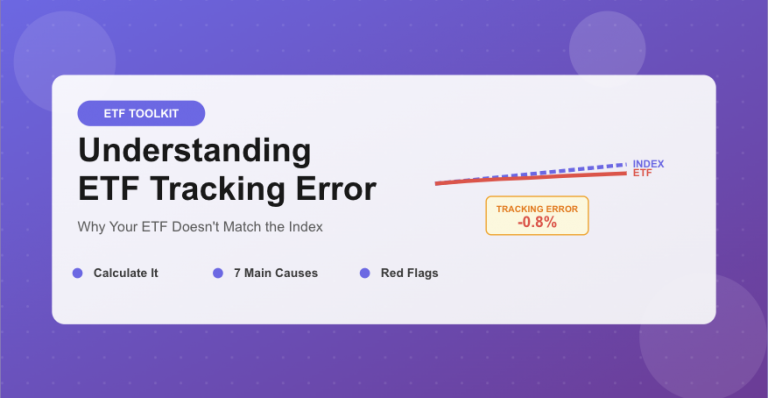

The ETF expense ratio creates tracking error relative to the index. A 0.50% expense ratio means the ETF should underperform its benchmark by approximately 0.50% annually, assuming perfect execution. When you see larger underperformance, that indicates additional problems beyond the stated ETF expense ratio.

What’s Included in ETF Expense Ratios

The ETF expense ratio covers multiple operational costs:

Management Fees: The largest component of most ETF expense ratios. This compensates the investment advisor for managing the portfolio and making investment decisions (even for passive index funds).

Administrative Costs: Legal, compliance, accounting, and record-keeping expenses are included in the ETF expense ratio.

Custodian Fees: The bank or institution holding the ETF’s securities charges fees covered by the ETF expense ratio.

Marketing and Distribution (12b-1 Fees): Some funds include marketing costs in their ETF expense ratio, though this is less common in ETFs than mutual funds.

What’s NOT Included in ETF Expense Ratios

Critically, the ETF expense ratio doesn’t include all costs of ETF ownership:

Trading Commissions: What you pay your broker to buy/sell the ETF isn’t part of the ETF expense ratio.

Bid-Ask Spreads: The difference between buying and selling prices costs you money but doesn’t appear in the ETF expense ratio.

Portfolio Trading Costs: When the ETF itself buys/sells securities (rebalancing, index changes), those transaction costs reduce returns but aren’t explicitly captured in the ETF expense ratio.

This means the true cost of ETF ownership exceeds the stated ETF expense ratio. For highly liquid large-cap ETFs, additional costs might be 0.01-0.05% annually. For less liquid international or small-cap ETFs, hidden costs beyond the expense ratio can add another 0.10-0.30% annually.

The Devastating Mathematics of ETF Expense Ratios Over Time

Here’s where understanding ETF expense ratios becomes financially critical. Small percentage differences compound into massive dollar differences over investment lifetimes.

ETF Expense Ratio Impact: 30-Year Comparison

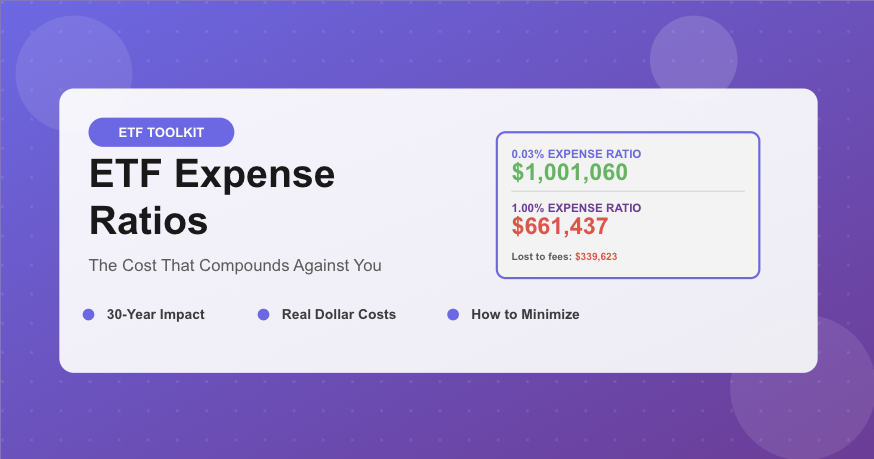

Let’s examine how different ETF expense ratios affect a $100,000 investment over 30 years, assuming 8% annual market returns before fees:

Study this table carefully. The difference between a 0.03% ETF expense ratio and a 1.00% expense ratio costs you $339,623 on a $100,000 investment over 30 years. You lose 34% of your potential wealth to fees. That’s not a rounding error—that’s the difference between financial security and running short in retirement.

🚨 Critical Insight on ETF Expense Ratios:

Notice how the damage from high ETF expense ratios accelerates over time. The cost isn’t linear—it’s exponential. A 0.50% expense ratio doesn’t cost you 0.50% of your gains; it costs you 19% of your 30-year wealth. A 1.00% ETF expense ratio destroys 34% of your potential retirement savings. This is why obsessing over ETF expense ratios isn’t nitpicking—it’s essential wealth protection.

ETF Expense Ratio Impact on Monthly Contributions

The ETF expense ratio impact grows even more dramatic with regular contributions. Consider investing $500 monthly for 30 years (total contributions: $180,000):

A 1.00% ETF expense ratio costs you $253,128 compared to a 0.03% expense ratio—more than your total contributions ($180,000). This means high ETF expense ratios literally consume more than everything you personally contributed, stealing from your investment returns to pay fund managers.

How to Evaluate ETF Expense Ratios: Category Benchmarks

Not all ETF expense ratios can be compared directly. A 0.50% expense ratio might be excellent for an actively managed emerging markets fund but terrible for an S&P 500 index fund. Understanding reasonable ETF expense ratios by category is essential.

ETF Expense Ratio Benchmarks by Asset Class

U.S. Large-Cap Equity ETFs:

• Excellent ETF expense ratio: 0.03% – 0.05%

• Acceptable ETF expense ratio: 0.05% – 0.10%

• High ETF expense ratio: Above 0.15%

• Examples: VOO (0.03%), SPY (0.09%), IVV (0.03%)

U.S. Mid-Cap and Small-Cap Equity ETFs:

• Excellent ETF expense ratio: 0.04% – 0.07%

• Acceptable ETF expense ratio: 0.07% – 0.20%

• High ETF expense ratio: Above 0.25%

International Developed Markets ETFs:

• Excellent ETF expense ratio: 0.05% – 0.10%

• Acceptable ETF expense ratio: 0.10% – 0.30%

• High ETF expense ratio: Above 0.40%

• Examples: VEA (0.05%), IEFA (0.07%), EFA (0.32%)

Emerging Markets ETFs:

• Excellent ETF expense ratio: 0.10% – 0.15%

• Acceptable ETF expense ratio: 0.15% – 0.50%

• High ETF expense ratio: Above 0.70%

• Note: Emerging markets ETFs justify higher expense ratios due to trading costs and custody challenges

U.S. Bond ETFs:

• Excellent ETF expense ratio: 0.03% – 0.05%

• Acceptable ETF expense ratio: 0.05% – 0.15%

• High ETF expense ratio: Above 0.25%

• Examples: BND (0.03%), AGG (0.03%)

Sector-Specific ETFs:

• Excellent ETF expense ratio: 0.10% – 0.20%

• Acceptable ETF expense ratio: 0.20% – 0.40%

• High ETF expense ratio: Above 0.50%

Actively Managed ETFs:

• Excellent ETF expense ratio: 0.30% – 0.50%

• Acceptable ETF expense ratio: 0.50% – 0.75%

• High ETF expense ratio: Above 1.00%

• Note: Active management justifies higher expense ratios only if the fund consistently outperforms after fees

📊 Real Example: ETF Expense Ratio Comparison

Scenario: Three S&P 500 ETFs with different expense ratios

VOO (Vanguard S&P 500): 0.03% expense ratio

IVV (iShares Core S&P 500): 0.03% expense ratio

SPY (SPDR S&P 500): 0.09% expense ratio

All three track the identical index. SPY charges 3x the ETF expense ratio of VOO and IVV. Over 30 years on $100,000, SPY’s higher expense ratio costs approximately $60,000 in lost wealth versus VOO.

The only justification for SPY’s higher ETF expense ratio: it has slightly better liquidity for active traders. For long-term investors, that liquidity advantage doesn’t justify paying triple the expense ratio and losing $60,000 over 30 years.

Hidden Costs Beyond the Stated ETF Expense Ratio

The official ETF expense ratio isn’t the complete cost story. Several additional expenses affect your returns but don’t appear in the ETF expense ratio:

Trading Costs and Portfolio Turnover

When an ETF rebalances its portfolio or responds to index changes, it incurs trading costs: commissions, bid-ask spreads, and market impact. These costs reduce fund performance but aren’t captured in the ETF expense ratio.

High portfolio turnover amplifies these hidden costs beyond the ETF expense ratio. An ETF with 100% annual turnover essentially replaces its entire portfolio yearly, generating substantial trading costs not reflected in the expense ratio.

Bid-Ask Spreads When You Trade

Every time you buy or sell an ETF, you pay the bid-ask spread—the difference between the buying price and selling price. This cost is separate from the ETF expense ratio and varies by fund liquidity.

For highly liquid large-cap ETFs, bid-ask spreads might be $0.01 per share (0.002% on a $50 ETF). For less liquid international or sector ETFs, spreads can reach 0.10-0.30%, far exceeding the ETF expense ratio for that single trade.

Premium/Discount to NAV

ETFs trade at market prices that occasionally diverge from their net asset value (NAV). Buying at a premium or selling at a discount imposes costs beyond the ETF expense ratio. For most large ETFs, these discrepancies are minimal (under 0.05%), but smaller or less liquid ETFs can trade at 0.50%+ premiums/discounts.

How to Minimize ETF Expense Ratio Impact

Now that you understand the devastating long-term cost of high ETF expense ratios, implement these strategies to protect your wealth:

Strategy 1: Always Compare ETF Expense Ratios Within Categories

Never evaluate an ETF expense ratio in isolation. Search for at least 3 competitor funds tracking similar indexes or strategies. If your candidate’s expense ratio exceeds the category average by 50%+, you need a compelling justification to proceed.

Strategy 2: Favor Low-Cost Index ETFs for Core Holdings

Your portfolio’s core positions (60-80% of assets) should use ultra-low-cost broad market ETFs with expense ratios under 0.10%. Save higher-expense-ratio specialized funds for smaller tactical positions (5-10% of portfolio).

Strategy 3: Calculate the Real Dollar Cost

Don’t just compare ETF expense ratio percentages—calculate actual dollar costs over your investment timeline. A 0.40% expense ratio difference might sound trivial, but when you calculate it costs $100,000+ over 30 years on your portfolio, the decision becomes obvious.

Strategy 4: Review Expense Ratios Annually

ETF providers occasionally lower expense ratios to remain competitive. Additionally, new lower-cost alternatives frequently launch. Review your portfolio’s ETF expense ratios annually and consider switching if you find materially cheaper alternatives (0.10%+ difference) for the same exposure.

Strategy 5: Accept Higher Expense Ratios Only With Justification

A higher ETF expense ratio is acceptable when: (1) no lower-cost alternative exists for your desired exposure, (2) the fund is actively managed and consistently outperforms its benchmark after fees, or (3) the specialized strategy genuinely warrants higher costs. Otherwise, choose the lowest expense ratio option.

ETF Expense Ratios vs Mutual Fund Fees: The Advantage

One reason ETFs have exploded in popularity: their expense ratios dramatically undercut traditional mutual funds. The average actively managed mutual fund charges 0.75-1.25% annually—3-10x higher than comparable ETF expense ratios.

This ETF expense ratio advantage compounds into massive wealth differences. A $200,000 portfolio in mutual funds charging 1.00% versus ETFs charging 0.10% costs approximately $200,000 in lost wealth over 30 years. The lower ETF expense ratios alone justify their use for most long-term investors.

Common Myths About ETF Expense Ratios

Myth #1: “Higher ETF expense ratios mean better management.”

False. Numerous studies show that higher-expense-ratio funds don’t outperform lower-cost alternatives after fees. In fact, the opposite is true: the single best predictor of future fund performance is low expense ratios.

Myth #2: “ETF expense ratio differences are too small to matter.”

Completely wrong. As demonstrated, seemingly small ETF expense ratio differences compound into six-figure wealth destruction over investment lifetimes. A 0.50% difference isn’t “too small to matter”—it’s retirement-altering.

Myth #3: “I can’t control expense ratios, so why worry?”

You have complete control over ETF expense ratios—simply choose lower-cost funds. Unlike market returns (which are unpredictable), expense ratios are guaranteed costs you can minimize through smart fund selection.

Myth #4: “Expensive ETFs must charge more because they’re better.”

Marketing, not quality, often explains high ETF expense ratios. Many expensive funds simply haven’t faced competitive pressure to lower fees. Identical index exposure frequently costs 10x more at one provider versus another—pure fee extraction, not superior management.

💰 Protect Your Wealth

You now understand how ETF expense ratios compound into massive long-term costs.

Review your current portfolio’s expense ratios TODAY. Calculate your 30-year cost.

Every 0.10% you eliminate in fees adds $25,000+ to your retirement nest egg.

📈 Next in ETF Toolkit Series: Now that you understand expense ratio mathematics, we’ll tackle “Understanding ETF Tracking Error”—why your ETF doesn’t perfectly match its index and what that costs you. Essential knowledge for serious investors!