High Dividend ETF Myths Debunked: Why Chasing Yield Destroys Wealth and Returns

High dividend ETF myths lure income-hungry investors into underperforming portfolios. The promise of 6-8% yields sounds irresistible, but these dividend ETF myths hide dangerous truths: dividend cuts disguised as sustainability, total return underperformance, and tax inefficiency that destroys wealth. This guide exposes the dividend ETF myths Wall Street profits from—and what actually works for income investors.

Why Dividend ETF Myths Persist and Cost Investors Millions

Dividend ETF myths remain widespread because they appeal to powerful psychological desires: steady income, safety, and avoiding market timing. Financial media reinforces these dividend ETF myths with headlines like “10 High-Yield ETFs for Passive Income” that ignore total return mathematics and tax consequences.

The reality behind dividend ETF myths: dividends aren’t “free money”—they’re simply cash distributions from companies you already own. When a stock pays a $2 dividend, the stock price drops by approximately $2 on the ex-dividend date. You haven’t gained anything; you’ve merely converted unrealized gains into taxable cash. Understanding this fundamental truth exposes most dividend ETF myths as financial illusions.

This guide systematically debunks six dangerous dividend ETF myths that cost investors significant wealth through underperformance, excessive taxes, and poor risk management. Once you see through these dividend myths, you’ll make dramatically better investment decisions.

Dividend ETF Myth #1: “High Dividend Yields = Higher Total Returns”

The most pervasive of all dividend ETF myths: chasing high yields produces superior long-term returns. This dividend myth is mathematically false and historically disproven, yet it persists because it feels intuitively correct.

The Total Return Reality Behind This Dividend ETF Myth

Total return equals price appreciation plus dividends. High-dividend stocks often exhibit lower price appreciation because they distribute cash rather than reinvesting for growth. This trade-off means high-yield dividend ETF myths about superior returns collapse under scrutiny.

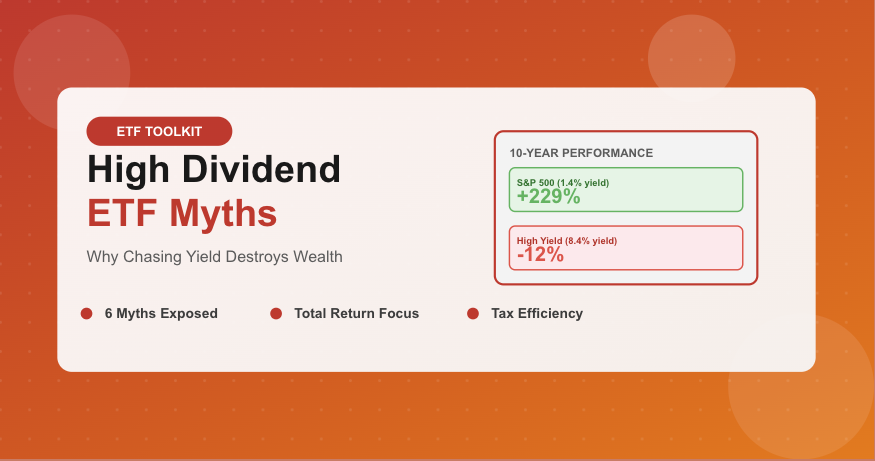

Let’s examine actual performance data that destroys this dividend ETF myth:

*Approximate 10-year returns as of 2024

This data obliterates the dividend ETF myth that higher yields produce higher returns. The lowest-yielding fund (VOO at 1.4%) delivered the highest total return (12.7% annually). The highest-yielding fund (SDIV at 8.4%) actually lost money (-1.3% annually) over a decade despite “paying” 8% yields.

🚨 Critical Insight on This Dividend ETF Myth:

On $100,000 invested for 10 years, the “boring” S&P 500 ETF grew to $329,000 while the “exciting” 8% yield ETF shrank to $88,000. The high dividend ETF myth cost investors $241,000 in this comparison. This is why yield chasing is financial suicide—the dividend myth promises income but delivers wealth destruction.

Why This Dividend ETF Myth Persists

This dividend ETF myth survives because investors confuse cash flow with returns. Receiving quarterly dividend checks feels like “making money” even when the underlying shares decline in value. Meanwhile, growth stocks that reinvest earnings rather than distributing them produce higher long-term wealth despite paying minimal dividends.

The mathematical reality: $100 growing to $200 (100% gain, 0% dividend) creates more wealth than $100 growing to $140 plus $30 in dividends (40% gain, 30% dividends, 70% total return). Yet the dividend myth convinces investors the second scenario is superior because they “received income.”

Dividend ETF Myth #2: “Dividend Stocks Are Safer and Less Volatile”

The second dangerous dividend ETF myth: high-dividend stocks provide stability and downside protection during bear markets. Historical data thoroughly debunks this dividend myth.

Dividend ETF Myth vs Reality: Bear Market Performance

Let’s examine how dividend-focused strategies performed during the 2008 financial crisis and 2020 COVID crash—the ultimate tests of this dividend ETF myth:

This destroys the dividend ETF myth about safety. High-dividend strategies didn’t provide downside protection—they often performed worse during crashes. REIT ETFs (popular for high yields) suffered catastrophic losses exceeding the broader market. The dividend myth of “defensive” characteristics proved false precisely when investors needed protection most.

Why High Dividend ETFs Fall Harder

This dividend ETF myth fails because:

Sector Concentration: High-dividend ETFs overweight utilities, financials, energy, and REITs—sectors that experience severe volatility during crises. The dividend myth of diversification collapses when you realize these funds concentrate risk rather than spreading it.

Dividend Cuts Amplify Losses: During recessions, companies cut dividends. High-dividend stocks experience double punishment: falling stock prices plus dividend cuts. The dividend myth that yield provides stability ignores this compounding effect.

Value Trap Risk: Many high-yield stocks are cheap for good reasons: declining businesses, unsustainable payouts, or obsolete business models. The dividend ETF myth mistakes distressed valuations for investment opportunities.

Dividend ETF Myth #3: “Dividends Are Free Money”

Perhaps the most fundamental of all dividend ETF myths: dividends represent “free” income on top of stock ownership. This dividend myth reflects a complete misunderstanding of how dividends work mechanically.

The Dividend Illusion: How This ETF Myth Deceives Investors

When a company pays a dividend, the stock price adjusts downward by approximately the dividend amount on the ex-dividend date. This isn’t a market quirk—it’s mathematical necessity. If a $100 stock pays a $2 dividend, you now own a $98 stock plus $2 cash. Your total wealth remains $100.

📊 Exposing the Dividend ETF Myth: Real Example

Scenario 1: Dividend-Paying Stock

• Buy stock at $100

• Company pays $3 dividend

• Stock price drops to $97 on ex-dividend date

• You have: $97 stock + $3 cash = $100 total

• Taxes owed on $3 dividend: ~$0.45 (15% rate)

• After-tax value: $99.55

Scenario 2: Non-Dividend Growth Stock

• Buy stock at $100

• Company reinvests profits, no dividend

• Stock appreciates to $103 (same $3 of value creation)

• You have: $103 stock = $103 total

• Taxes owed: $0 (unrealized gains, not taxed until you sell)

• After-tax value: $103.00

The dividend ETF myth says Scenario 1 is better because you “received income.” Reality: Scenario 2 leaves you $3.45 wealthier because you avoided forced taxation. Dividends aren’t free—they trigger immediate tax liability while providing no actual wealth gain. This dividend myth costs investors billions annually in unnecessary taxes.

Why Investors Believe This Dividend ETF Myth

This dividend myth persists due to mental accounting errors. Receiving cash dividends feels different psychologically than selling shares, even though both convert ownership into cash. The dividend ETF myth exploits this cognitive bias, making investors believe they’re “earning income” when they’re actually just converting capital into taxable distributions.

Additionally, brokers and financial advisors perpetuate this dividend myth because dividend-focused strategies generate more activity (dividend reinvestment, tax reporting) and justify higher fees. The dividend ETF myth benefits the financial industry while harming investor outcomes.

Dividend ETF Myth #4: “You Need Dividends for Retirement Income”

The fourth pervasive dividend ETF myth: retirees must own high-dividend ETFs to generate income without “touching principal.” This dividend myth ignores superior alternatives and creates tax inefficiency.

The Total Return Approach vs The Dividend Myth

The dividend ETF myth argues: “Own dividend stocks yielding 4%, live on dividends, never sell shares, preserve capital forever.” This sounds appealing until you examine the alternative:

Dividend-Focused Approach (The Myth):

• Portfolio: $1,000,000 in 4% dividend ETFs

• Annual income: $40,000 from dividends

• Annual taxes: ~$6,000 (15% on dividends)

• After-tax income: $34,000

• Portfolio value appreciation: ~6% annually (lower growth)

Total Return Approach (Reality):

• Portfolio: $1,000,000 in diversified growth ETFs (1.5% yield)

• Needed income: $40,000

• Generate income: Sell $40,000 worth of shares

• Annual taxes: ~$2,400 (15% on $16,000 long-term gains)*

• After-tax income: $37,600

• Portfolio value appreciation: ~9% annually (higher growth)

• Tax efficiency: You control when to realize gains

*Assumes 60% cost basis on sold shares

The total return approach delivers $3,600 more annual after-tax income while maintaining a faster-growing portfolio. Over 30 years of retirement, this dividend ETF myth costs approximately $250,000 in lost wealth and income. Yet retirees cling to the dividend myth because it feels safer to “live off dividends.”

💡 Debunking the Dividend ETF Myth:

Selling 4% of shares annually is mathematically identical to receiving 4% dividends—both convert ownership to cash. The difference: you control the timing and tax consequences when you sell shares. Dividends force taxable events whether you need the cash or not. The dividend myth that selling shares “depletes principal” while dividends don’t is pure financial illusion. Both reduce your ownership stake proportionally.

The 4% Rule Works With Any Portfolio

The famous 4% safe withdrawal rate works with growth portfolios, value portfolios, or dividend portfolios—the dividend ETF myth that you need dividends specifically is false. The 4% rule succeeds based on total return, not income composition. High-growth portfolios often support 4% withdrawals more sustainably than high-dividend portfolios because they compound faster.

Dividend ETF Myth #5: “Dividend Growth Protects Against Inflation”

The fifth dividend ETF myth: companies that consistently raise dividends provide inflation protection. While dividend growth sounds appealing, this dividend myth ignores that price appreciation also beats inflation—often more effectively.

Historical Performance vs This Dividend Myth

Over the past 30 years (1994-2024):

Dividend Aristocrats (Companies with 25+ Years of Dividend Growth):

• Average annual return: ~10.5%

• Average dividend growth: ~6.2% annually

• Inflation: ~2.5% annually

• Real dividend growth: ~3.7% annually

S&P 500 Total Market:

• Average annual return: ~10.8%

• Average dividend growth: ~5.8% annually

• Capital appreciation: ~9.3% annually

• Inflation: ~2.5% annually

• Real total return: ~8.3% annually

The dividend ETF myth claims dividend growth provides superior inflation protection. Reality: total return matters, not just dividend growth. While dividend aristocrats grew dividends at 6.2%, their total returns (10.5%) actually slightly underperformed the broader market (10.8%). The dividend myth confuses dividend growth with total wealth growth.

Why Price Appreciation Beats the Dividend Myth

Growth stocks that pay minimal dividends often provide superior inflation protection through price appreciation. Technology companies, for example, rarely pay dividends but have dramatically outpaced inflation through stock price growth. The dividend ETF myth ignores this reality, focusing exclusively on dividend income while missing superior wealth creation.

Dividend ETF Myth #6: “Covered Call Strategies Boost Dividend Yields Safely”

The sixth dangerous dividend ETF myth: covered call ETFs offering 10-15% “dividend” yields provide safe income enhancement. These products represent perhaps the most insidious of all dividend ETF myths because they disguise return of capital and capped upside as “high income.”

How Covered Call ETFs Perpetuate Dividend Myths

Covered call ETFs sell call options on their holdings, generating premium income distributed as “dividends.” This creates the dividend ETF myth that you’re earning 10%+ yields. The reality:

What You Actually Get:

• Option premium income (taxed as ordinary income, not qualified dividends)

• Capped upside: You surrender gains above the call strike price

• Full downside exposure: You experience all losses

• Return of capital: Distributions often include your own capital being returned

The Hidden Cost of This Dividend Myth:

The dividend ETF myth around covered calls: “You get 10% income while maintaining stock exposure.” Reality: You sacrifice 10-15% of upside in exchange for 2-4% of downside protection. In sustained bull markets, this dividend myth destroys wealth. Over the past 10 years, covered call ETFs dramatically underperformed simple buy-and-hold strategies despite advertising high “yields.”

🚨 Warning on This Dividend ETF Myth:

Covered call ETFs often distribute return of capital (ROC), not actual income. When 30-50% of distributions are ROC, you’re literally receiving your own money back and paying taxes on it. The high dividend ETF myth obscures this wealth-destroying mechanism behind attractive “yield” numbers. Check your 1099-DIV for Box 3 (non-dividend distributions)—this reveals how much of your “dividend” was actually ROC.

What Actually Works: Beyond Dividend ETF Myths

Now that we’ve debunked the major dividend ETF myths, what strategies actually work for investors seeking income and growth?

Strategy 1: Focus on Total Return, Not Yield

Abandon the dividend ETF myth that yield matters more than total return. A fund returning 12% annually with 1% yield vastly outperforms a fund returning 7% annually with 4% yield. Prioritize total wealth growth; generate income by selling small amounts as needed.

Strategy 2: Use Qualified Dividend ETFs in Taxable Accounts

If you must own dividend-paying ETFs in taxable accounts, ensure dividends are qualified (taxed at 15% vs 37%). U.S. large-cap equity ETFs produce mostly qualified dividends. REIT ETFs and bond ETFs produce ordinary income—keep these in retirement accounts where the tax implications are deferred.

Strategy 3: Consider Dividend Growth, Not High Current Yield

If dividends matter to you psychologically, focus on dividend growth rather than current yield. Companies growing dividends 7-10% annually compound income faster than high-yield companies barely maintaining payouts. The “boring” 2% yield growing 10% annually surpasses the “exciting” 5% yield growing 2% annually within just 8 years.

Strategy 4: Implement Total Return Withdrawal Strategy

For retirees, sell 3-4% of portfolio value annually from diversified growth ETFs. This approach provides superior tax control, higher total returns, and equivalent income to dividend-focused strategies. The dividend ETF myth that you must “live off dividends” costs retirees tens of thousands in unnecessary taxes and underperformance.

Strategy 5: Recognize When Dividends Make Sense

Dividends aren’t always bad—they’re simply not magical. Reasonable scenarios for dividend-focused investing:

• You’re psychologically unable to sell shares (despite mathematical equivalence)

• You need income in retirement accounts (where tax efficiency doesn’t matter)

• You want forced discipline through regular distributions

• You invest in dividend aristocrats for quality screening, not yield chasing

The key: understand you’re making a psychological choice, not a mathematically superior one. Don’t fall for dividend ETF myths claiming dividend strategies inherently beat total return approaches.

The Bottom Line on Dividend ETF Myths

The six dividend ETF myths we’ve debunked cost investors billions annually through:

1. Chasing high yields into underperforming investments

2. Believing dividends provide safety that doesn’t exist

3. Treating dividends as “free money” and paying unnecessary taxes

4. Forcing retirement income from dividends instead of using total return

5. Assuming dividend growth beats price appreciation for inflation protection

6. Falling for covered call “high yield” gimmicks that cap upside

The mathematical truth: total return matters. How that return is composed (dividends vs appreciation) is largely irrelevant for long-term wealth accumulation. The dividend ETF myths persist because they feel good emotionally—receiving cash dividends provides psychological satisfaction even when it destroys after-tax wealth.

Smart investors see through these dividend myths and focus on total return, tax efficiency, and portfolio growth. They understand dividends aren’t magic—they’re simply one component of returns, often the least tax-efficient component.

🎯 Escape Dividend ETF Myths

You now see through the dividend ETF myths that trap income investors.

Review your portfolio: Are you chasing yield at the expense of total return?

Shift your focus from dividend income to total wealth growth—your future self will thank you.

📈 Coming Up in ETF Toolkit Series: You’ve completed the core ETF knowledge foundation! Next month, we’ll publish our first “Monthly ETF Market Wrap-up” analyzing current market conditions, sector performance, and actionable insights for your portfolio. Don’t miss it!