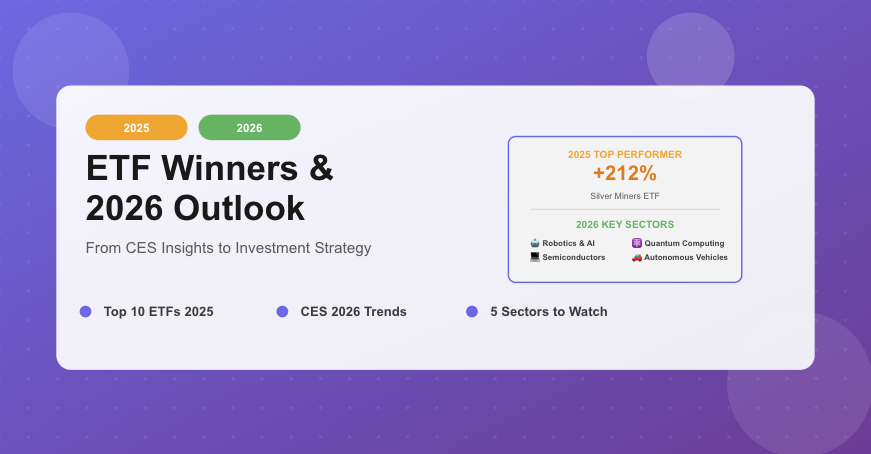

2025 ETF Winners & 2026 Outlook: From Precious Metals Surge to CES Robotics Revolution

2025 delivered stunning returns for investors who positioned correctly—precious metals ETFs soared over 200%, while tech-focused funds captured AI momentum with 48% gains. But as we enter 2026, CES reveals a dramatic shift: robotics, quantum computing, and physical AI are reshaping investment landscapes. This comprehensive review shows what worked in 2025 and where smart money is positioning for 2026.

Top 10 Performing ETFs of 2025: The Winners That Delivered

2025 proved that sector selection matters more than market timing. While the S&P 500 delivered a respectable 16% return, strategic ETF investors captured returns exceeding 200% by identifying the year’s dominant themes: precious metals, technology innovation, and defense.

The Precious Metals Phenomenon: A Historic Rally

Precious metals dominated 2025’s ETF leaderboard with unprecedented returns. Silver prices surged 149% while gold rose 71%, driven by a perfect storm: geopolitical tensions, inflation concerns, Federal Reserve policy uncertainty, and speculative momentum. Mining companies, which benefit from operational leverage, delivered even more explosive gains than the commodities themselves.

💡 Investment Simulation Value:

A $10,000 investment in SLVP at the start of 2025 grew to $31,200 by year-end. Compare this to the S&P 500, where the same investment reached just $11,600. The silver miners ETF delivered 170% more absolute dollar gains than the broad market—turning a modest five-figure investment into meaningful wealth.

Technology & Innovation: The ARK Funds Comeback

After years of underperformance, Cathie Wood’s ARK Innovation ETFs staged a dramatic comeback in 2025. The robotics-focused ARKQ led with 48.7% returns as autonomous technology and AI-powered systems captured investor imagination. This demonstrates a crucial advantage of ETFs over individual stock picking: instant diversification across an emerging theme without betting everything on a single company.

📊 ETF vs Direct Investment: The Sarah Chen Story

Sarah’s Challenge: In January 2025, Sarah wanted exposure to the robotics revolution but didn’t know which specific companies to buy.

Option A – Individual Stock Picking:

• Researched 20 robotics companies

• Chose 5 stocks she felt confident about

• One company went bankrupt (-100%)

• Two underperformed (+5%, +12%)

• Two succeeded (+45%, +67%)

• Portfolio weighted average return: +18.2%

• Time invested: 40+ hours research

Option B – ARKQ ETF:

• Bought ARKQ on day one

• Gained exposure to 40+ robotics companies instantly

• Professional management adjusted holdings throughout year

• Return: +48.7%

• Time invested: 15 minutes

Result: The ETF delivered 2.7x higher returns with 99% less time commitment. This is the power of professional sector expertise combined with diversification—exactly what individual investors cannot replicate alone.

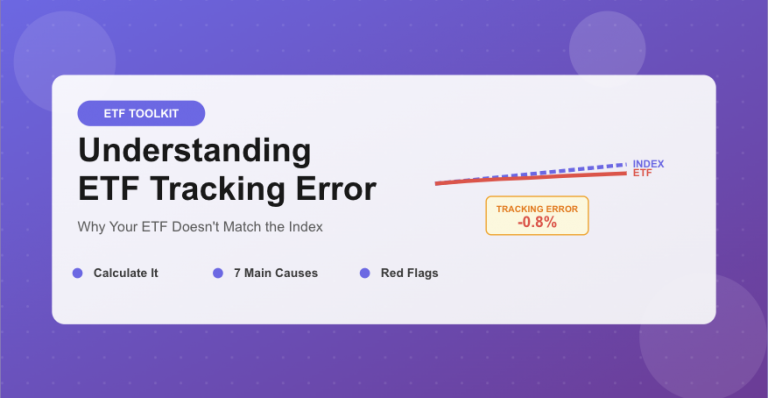

What 2025 Teaches Us About ETF Investing

Lesson 1: Sector Selection Matters More Than Market Timing

The difference between the top-performing ETF (+212%) and the S&P 500 (+16%) was 196 percentage points—entirely due to sector choice. Investors who identified precious metals and robotics as 2025’s themes captured exponentially higher returns than those who stayed in broad market indexes.

Lesson 2: Volatility Creates Opportunity

The High Beta ETF (SPHB) delivered 32.8% by focusing on the most volatile S&P 500 stocks. Higher volatility doesn’t equal lower returns—it equals higher potential returns for those with appropriate risk tolerance and time horizons.

Lesson 3: Active Management Can Outperform in Emerging Sectors

Five of the top 10 ETFs were actively managed, crushing the myth that passive always beats active. In rapidly evolving sectors like robotics and technology, active managers who can pivot quickly and identify winners delivered superior results.

2026 Outlook: Five Sectors to Watch Based on CES 2026 Trends

CES 2026, held January 6-9 in Las Vegas, revealed the technology trends that will dominate the coming year. After analyzing keynotes from Nvidia, AMD, Google, and dozens of other industry leaders, five sectors emerge as critical investment themes for 2026.

Sector #1: Robotics & Physical AI – The Breakout Year

CES 2026 was dominated by humanoid robots and physical AI systems. Nvidia CEO Jensen Huang declared physical AI “the moment robots go mainstream,” unveiling new foundation models and simulation tools specifically for robotics. Boston Dynamics debuted its production-ready Atlas robot, Hyundai announced mass production plans, and dozens of companies showcased working robots deployed in factories, warehouses, and homes.

🤖 Sector Deep Dive: Robotics & Physical AI

Why This Sector Matters for 2026:

McKinsey estimates the general-purpose robotics market will reach $370 billion by 2040, with explosive growth beginning in 2026 as commercial deployments accelerate. Unlike previous years of “concept robots,” CES 2026 showcased robots with defined jobs, commercial customers, and 2026 deployment timelines.

Key Drivers:

- AI breakthroughs enabling robots to reason, learn, and adapt

- Labor shortages in warehouses, manufacturing, and healthcare

- Nvidia, AMD, Intel, and Qualcomm all launching robot-specific chips

- Boston Dynamics’ Atlas deploying at Hyundai factories in 2026

- Google DeepMind partnering with robot manufacturers

Recommended ETFs:

ARK Autonomous Technology & Robotics ETF (ARKQ)

• 2025 Return: +48.7%

• Expense Ratio: 0.75%

• Holdings: 40+ companies across robotics, automation, AI

• Why it works: Active management pivots quickly to emerging robotics winners

Global X Robotics & AI ETF (BOTZ)

• Expense Ratio: 0.68%

• Holdings: Industrial automation, surgical robots, autonomous vehicles

• Why it works: Broad global exposure to robotics supply chain

ROBO Global Robotics & Automation ETF (ROBO)

• Expense Ratio: 0.95%

• Holdings: 80+ pure-play robotics companies

• Why it works: Most diversified robotics exposure available

Sector #2: Semiconductors & AI Chips – The Infrastructure Play

Every major chip manufacturer used CES 2026 to announce next-generation AI processors. Nvidia unveiled the Rubin platform promising “10x cost reduction for AI compute,” AMD showcased Ryzen AI 400 series, Intel launched Core Ultra Series 3, and Qualcomm debuted Dragonwing robot chips. The semiconductor sector remains the foundational infrastructure powering AI expansion.

💻 Sector Deep Dive: Semiconductors & AI Chips

Why This Sector Matters for 2026:

The AI revolution requires massive computational infrastructure. Data centers are expanding globally, autonomous vehicles need edge computing, and robotics demand specialized processors. Semiconductor companies supply the picks and shovels for the AI gold rush.

Key Drivers:

- AI model training demand growing exponentially

- Edge computing for robotics and autonomous systems

- Data center buildout accelerating globally

- Next-generation chips delivering 10x performance improvements

- Governments prioritizing domestic chip manufacturing

Recommended ETFs:

VanEck Semiconductor ETF (SMH)

• 10-Year Return: $10,000 → $150,000+ (1,400%+ gain)

• Expense Ratio: 0.35%

• Holdings: Nvidia, TSMC, ASML, AMD, Intel

• Why it works: Pure-play semiconductor exposure, proven long-term outperformer

iShares Semiconductor ETF (SOXX)

• 10-Year Return: $10,000 → $114,000 (1,040% gain)

• Expense Ratio: 0.35%

• Holdings: Top 30 U.S.-listed semiconductor companies

• Why it works: Concentrated exposure to chip leaders

Sector #3: Quantum Computing – The Emerging Frontier

CES 2026 debuted CES Foundry, a dedicated exhibition space for quantum computing and AI convergence. IBM, D-Wave Quantum, and SuperQ showcased quantum breakthroughs, while major tech companies announced quantum partnerships. This sector transitions from research to early commercial applications in 2026.

⚛️ Sector Deep Dive: Quantum Computing

Why This Sector Matters for 2026:

Quantum computing solves problems impossible for classical computers: drug discovery, materials science, financial modeling, and AI optimization. While still early-stage, 2026 marks the inflection point where quantum moves from lab experiments to commercial pilots.

Key Drivers:

- IBM, Google, and Amazon launching quantum cloud services

- Pharmaceutical companies using quantum for drug discovery

- Financial institutions piloting quantum for risk modeling

- Government investments in quantum research accelerating

- Hardware improvements making quantum more practical

Recommended ETFs:

Defiance Quantum ETF (QTUM)

• Expense Ratio: 0.40%

• Holdings: Companies developing quantum hardware, software, applications

• Why it works: Pure-play quantum computing exposure

Note: Quantum computing ETFs are high-risk, speculative investments. Allocate only 2-5% of portfolio to this emerging technology. Most investors should wait for the sector to mature before substantial allocation.

Sector #4: Autonomous Vehicles & Mobility – Production Readiness

Nvidia’s Alpamayo platform for autonomous driving, Mercedes-Benz CLA showcasing “AI-defined driving,” and Waymo’s expanded robotaxi deployments signal that autonomous vehicles transition from testing to production in 2026. This sector combines semiconductors, AI software, and automotive manufacturing.

🚗 Sector Deep Dive: Autonomous Vehicles

Why This Sector Matters for 2026:

Self-driving technology reaches Level 4 autonomy in specific environments, enabling commercial robotaxi services and autonomous trucking pilots. The $7 trillion global automotive market begins its transformation to software-defined, AI-powered mobility.

Key Drivers:

- Waymo expanding robotaxi services to multiple cities

- Tesla’s Full Self-Driving advancing toward unsupervised autonomy

- Autonomous trucking addressing driver shortage

- Regulatory frameworks clarifying in key markets

- Sensor costs declining, making autonomy economically viable

Recommended ETFs:

Global X Autonomous & Electric Vehicles ETF (DRIV)

• Expense Ratio: 0.68%

• Holdings: EV manufacturers, battery makers, autonomous tech companies

• Why it works: Captures entire autonomous vehicle ecosystem

iShares Self-Driving EV and Tech ETF (IDRV)

• Expense Ratio: 0.47%

• Holdings: Companies developing autonomous and electric vehicle technologies

• Why it works: Focused exposure to self-driving technology leaders

Sector #5: Cybersecurity & Enterprise AI – The Defense Layer

As AI deployment accelerates, cybersecurity becomes mission-critical. CES 2026 emphasized enterprise AI security, highlighting vulnerabilities in AI systems and the massive investments required to protect them. This defensive sector provides portfolio stability while capturing AI growth.

🛡️ Sector Deep Dive: Cybersecurity

Why This Sector Matters for 2026:

AI systems create new attack surfaces. Quantum computing threatens current encryption. Ransomware attacks intensify. Cybersecurity spending becomes non-discretionary as digital infrastructure expands. This sector offers defensive characteristics with growth potential.

Key Drivers:

- AI systems requiring specialized security solutions

- Quantum-resistant encryption deployment beginning

- Regulatory requirements driving security spending

- Cloud migration expanding attack surfaces

- Nation-state cyber threats escalating

Recommended ETFs:

First Trust NASDAQ Cybersecurity ETF (CIBR)

• Expense Ratio: 0.60%

• Holdings: Pure-play cybersecurity companies

• Why it works: Largest and most liquid cybersecurity ETF

Global X Cybersecurity ETF (BUG)

• Expense Ratio: 0.50%

• Holdings: Global cybersecurity leaders

• Why it works: International diversification in cyber defense

CES 2026 Key Takeaways: What Investors Must Know

CES 2026’s dominant themes reveal where technology—and investment dollars—are heading:

1. Physical AI is Here: Robots are no longer concepts. Companies showcased working humanoids deployed in factories, hospitals, and homes. Investment opportunity: robotics ETFs capturing this transition.

2. Chip Wars Intensify: Nvidia, AMD, Intel, and Qualcomm are battling for AI chip supremacy. Each announced major products at CES. Investment opportunity: semiconductor ETFs benefit regardless of which company wins.

3. Autonomous Everything: From cars to drones to delivery robots, autonomy is expanding beyond vehicles. Investment opportunity: mobility and robotics ETFs capture this convergence.

4. Quantum Transitions from Lab to Market: Quantum computing companies showcased commercial partnerships. Investment opportunity: early positioning in quantum ETFs before mainstream adoption.

5. AI Needs Infrastructure: Every AI advancement requires more chips, more data centers, more power, more security. Investment opportunity: infrastructure ETFs supporting AI buildout.

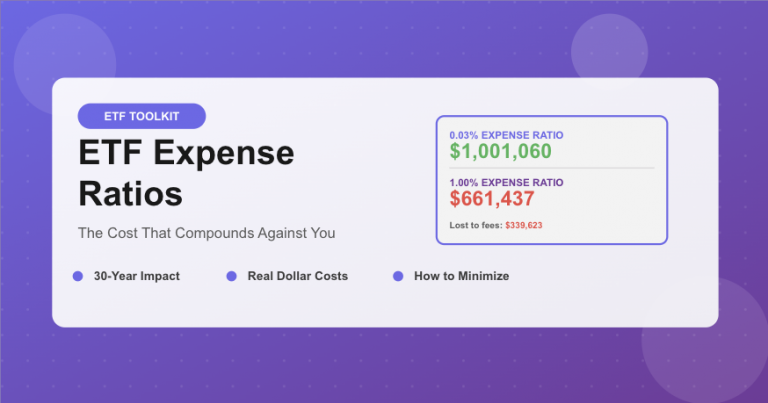

Portfolio Strategy for 2026: Sector Allocation Recommendations

Based on 2025 performance analysis and 2026 CES trends, here’s a tactical sector allocation framework:

Conservative Allocation (Lower Risk Tolerance):

• 60% Core Holdings: S&P 500 or Total Market ETF

• 15% Semiconductors: SMH or SOXX

• 10% Cybersecurity: CIBR or BUG

• 10% Robotics: ARKQ or BOTZ

• 5% Cash for Opportunities

Moderate Allocation (Balanced Approach):

• 50% Core Holdings: S&P 500 or Total Market ETF

• 20% Semiconductors: SMH or SOXX

• 15% Robotics: ARKQ or BOTZ

• 10% Autonomous Vehicles: DRIV or IDRV

• 5% Cybersecurity: CIBR

• Total: 100% (no cash, fully invested)

Aggressive Allocation (High Growth Seeking):

• 30% Core Holdings: S&P 500 or Total Market ETF

• 25% Semiconductors: SMH or SOXX

• 20% Robotics: ARKQ or BOTZ

• 10% Autonomous Vehicles: DRIV

• 10% Space & Defense: ARKX

• 3% Quantum Computing: QTUM

• 2% Precious Metals: SLVP (speculation only)

• Note: This allocation assumes high volatility tolerance and 10+ year horizon

What to Avoid in 2026

Understanding what not to invest in matters as much as knowing where to allocate capital:

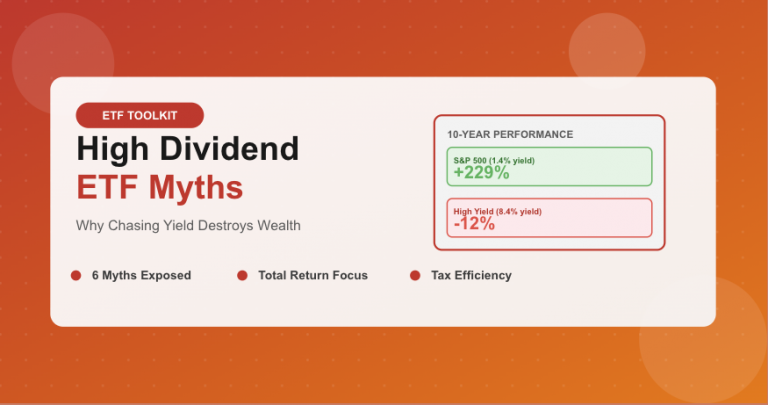

❌ Leveraged ETFs for Long-Term Holdings: The MicroSectors Gold Miners 3X Leveraged ETN gained 796% in 2025, but leveraged ETFs decay over time. They’re trading tools, not investments. Volatility drag destroys value in extended holdings.

❌ Single-Stock ETFs: 2025 saw an explosion of ETFs tracking individual stocks with leverage. These products combine the worst of two worlds: concentrated risk plus leverage decay. Avoid entirely for long-term portfolios.

❌ Chasing Last Year’s Winners: Precious metals delivered 200%+ returns in 2025. That doesn’t mean they’ll repeat in 2026. Gold and silver are trading at record highs—late entries risk buying tops. If you missed the precious metals rally, accept it and focus on 2026’s emerging themes.

❌ Over-Allocation to Speculative Themes: Quantum computing and humanoid robots are exciting, but they’re speculative. Limit exposure to 2-5% of portfolio maximum. Let these sectors prove commercial viability before substantial allocation.

🎯 Position for 2026’s Opportunities

2025 taught us that sector selection drives returns. 2026’s themes are clear: robotics, semiconductors, autonomy, quantum, and cybersecurity.

Review your portfolio today. Are you positioned for the trends CES 2026 revealed?

The early investors in emerging sectors capture exponential returns—don’t wait until themes become obvious.

📈 Next Month: We’ll publish our first “Monthly ETF Market Wrap-Up” analyzing January 2026 performance, sector rotation signals, and mid-month rebalancing opportunities. Subscribe to never miss market-moving insights!