ETF Tax Implications: What Your Broker Won’t Tell You About Capital Gains and Dividends

Your broker never mentions it, but ETF tax implications can cost you 20-37% of your returns if you’re not careful. Understanding ETF tax treatment—from capital gains to dividend taxation to the unique ETF creation/redemption mechanism—can save you tens of thousands over an investment lifetime. This is the tax guide your broker should have given you but didn’t.

Why ETF Tax Implications Matter More Than You Think

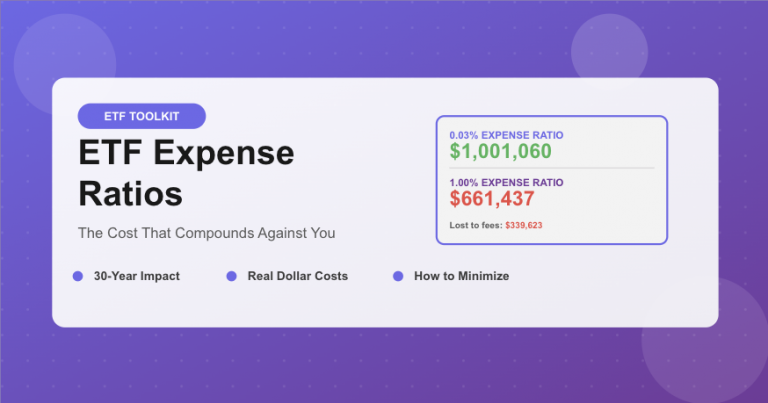

Most investors obsess over ETF tax returns and expense ratios while completely ignoring ETF tax implications—often the largest drag on actual wealth accumulation. Here’s the harsh reality: a fund returning 10% annually becomes 7.8% after federal taxes, 6.3% after state taxes in high-tax states. Those ETF tax implications compound into massive wealth destruction over decades.

Understanding ETF tax implications isn’t optional financial trivia—it’s essential wealth preservation. The difference between tax-efficient and tax-inefficient investing can exceed $200,000 over a 30-year investment horizon on a $100,000 portfolio. That’s not hyperbole; that’s mathematical reality when you understand how ETF tax treatment actually works.

This guide reveals the critical ETF tax implications every investor must understand: how ETFs are taxed, why ETFs are more tax-efficient than mutual funds, strategies to minimize ETF tax liability, and the mistakes that trigger massive unnecessary tax bills.

The Two Types of ETF Tax: Capital Gains and Dividends

When you invest in ETFs, you face two distinct categories of ETF tax implications:

1. Capital Gains Tax: The ETF Tax on Selling

Capital gains ETF tax applies when you sell ETF shares for more than you paid. This ETF tax implication splits into two critical categories with dramatically different tax rates:

Short-Term Capital Gains (Held ≤ 1 Year):

Taxed as ordinary income at your regular tax bracket (10-37% federal). This ETF tax rate means frequent trading in taxable accounts destroys wealth. A 37% ETF tax on short-term gains means you keep just 63 cents of every dollar in profit.

Long-Term Capital Gains (Held > 1 Year):

Preferential tax rates of 0%, 15%, or 20% depending on income. This favorable ETF tax treatment is why buy-and-hold investors accumulate significantly more wealth—they pay 15-20% ETF tax instead of 37% on gains.

*2025 tax brackets for long-term capital gains ETF tax rates

💡 Critical ETF Tax Implication:

The difference between short-term and long-term ETF tax treatment is massive. A $50,000 gain taxed short-term at 37% costs $18,500 in taxes. The same gain taxed long-term at 15% costs just $7,500. That’s an $11,000 difference—22% of your entire gain lost to unnecessary ETF tax by selling one day too early. This ETF tax implication alone justifies holding ETFs at least one year.

2. Dividend and Distribution Tax: The ETF Tax on Income

ETFs distribute income to shareholders, creating another ETF tax implication. These distributions fall into two categories with different ETF tax treatment:

Qualified Dividends:

Dividends from U.S. corporations and qualified foreign corporations receive preferential tax treatment—the same 0%/15%/20% rates as long-term capital gains. This favorable ETF tax treatment applies to most dividends from broad U.S. equity ETFs.

Ordinary Dividends (Non-Qualified):

Taxed at your regular income tax rate (10-37%). Bond ETF interest, REIT distributions, and some foreign dividends receive this unfavorable ETF tax treatment. This is why bond ETFs and REIT ETFs are heavily penalized in taxable accounts—all income faces maximum ETF tax rates.

Return of Capital (ROC):

Some ETFs distribute return of capital, which isn’t immediately taxable but reduces your cost basis. This deferred ETF tax implication seems beneficial initially but creates larger capital gains ETF tax bills when you eventually sell.

The ETF Tax Advantage: Why ETFs Beat Mutual Funds

ETFs offer a massive ETF tax advantage over mutual funds through their unique creation/redemption mechanism. Understanding this ETF tax implication reveals why ETFs are inherently more tax-efficient than their mutual fund cousins.

The ETF Creation/Redemption Process and Tax Implications

When investors want to buy or sell ETF shares, the fund doesn’t usually buy/sell underlying securities. Instead, “authorized participants” (large institutions) create or redeem ETF shares in large blocks by exchanging baskets of securities. This process has profound ETF tax implications:

In-Kind Transfers Avoid Capital Gains:

When an authorized participant redeems ETF shares, the fund delivers actual securities (in-kind transfer) rather than cash. This in-kind redemption doesn’t trigger taxable events. The ETF can selectively deliver its lowest-cost-basis shares, cleansing the fund of embedded capital gains. This unique ETF tax feature means ETFs rarely distribute capital gains to shareholders.

Mutual Funds Must Sell Securities:

When mutual fund investors redeem shares, the fund must sell securities for cash. These sales trigger capital gains that get distributed to all remaining shareholders—even those who didn’t sell anything. This terrible mutual fund tax implication means you pay taxes on other people’s selling activity.

📊 Real ETF Tax Advantage Example

Scenario: S&P 500 Index Fund (Mutual Fund) vs S&P 500 ETF

2023 Capital Gains Distributions:

• Vanguard 500 Index Fund (VFIAX – Mutual Fund): 0.87% distribution

• Vanguard S&P 500 ETF (VOO – ETF): 0.00% distribution

Both track the identical index. The mutual fund forced shareholders to pay taxes on 0.87% of their holdings—an unexpected tax bill averaging $870 per $100,000 invested (at 15% capital gains rate). VOO shareholders paid zero.

Over 30 years, this ETF tax advantage compounds into approximately $75,000 of additional wealth on a $100,000 investment. The ETF structure’s superior tax efficiency delivers this benefit automatically—no effort required from investors.

ETF Tax Efficiency by Asset Class

The ETF tax advantage varies by asset class. Understanding these differences optimizes your account location strategy:

U.S. Large-Cap Equity ETFs (Most Tax-Efficient):

Rarely distribute capital gains. Dividends are mostly qualified. Minimal ETF tax drag in taxable accounts. These are ideal for taxable account holdings.

U.S. Small-Cap and Value ETFs (Moderately Tax-Efficient):

Higher dividend yields and occasional small capital gains distributions. Slightly higher ETF tax implications but still reasonable for taxable accounts.

International Equity ETFs (Moderately Tax-Efficient):

Foreign tax credits offset some ETF tax liability. However, withholding taxes create complications. Some dividends may be non-qualified, increasing ETF tax drag.

Bond ETFs (Tax-Inefficient):

All interest taxed as ordinary income at your highest marginal rate. No preferential ETF tax treatment. Horrible ETF tax implications in taxable accounts—belongs in retirement accounts.

REIT ETFs (Extremely Tax-Inefficient):

Distributions largely taxed as ordinary income. Some may be return of capital (defers taxes). Terrible ETF tax efficiency—strongly prefer retirement accounts for REIT exposure.

Actively Managed and High-Turnover ETFs (Tax-Inefficient):

Frequent trading generates capital gains distributions. Higher ETF tax drag than passive index ETFs. The tax implications often negate any performance advantage.

ETF Tax Strategies: Minimizing Your Tax Bill

Understanding ETF tax implications enables powerful strategies to legally minimize taxes and maximize after-tax wealth:

Strategy 1: Asset Location Optimization

Place different ETFs in different account types based on ETF tax efficiency:

Taxable Accounts:

• U.S. equity ETFs (large-cap, total market)

• Tax-managed ETFs

• Growth-oriented ETFs (low dividends)

→ These have minimal ETF tax drag from qualified dividends and no capital gains distributions

Tax-Deferred Accounts (Traditional IRA, 401k):

• Bond ETFs

• REIT ETFs

• High-dividend ETFs

• Actively managed ETFs

→ These have terrible ETF tax implications in taxable accounts but grow tax-deferred here

Tax-Free Accounts (Roth IRA):

• Highest expected return ETFs

• Assets you’ll hold 20+ years

→ Maximum growth completely avoids ETF tax forever

✓ ETF Tax Optimization Example:

Investor with $300,000 split across accounts:

Taxable ($100k): VOO (S&P 500 ETF) – minimal ETF tax drag

Traditional IRA ($100k): BND (Bond ETF) – shields ordinary income from ETF tax

Roth IRA ($100k): VTI (Total Market ETF) – eliminates all future ETF tax

This asset location strategy saves approximately $1,500-2,500 annually in taxes compared to random placement. Over 30 years, that’s $125,000+ in tax savings through strategic account location.

Strategy 2: Tax-Loss Harvesting

Tax-loss harvesting uses ETF tax implications to your advantage by selling losing positions to offset gains:

How it works:

1. Sell an ETF position with unrealized losses

2. Immediately buy a similar (but not “substantially identical”) ETF

3. Use the realized loss to offset capital gains, reducing ETF tax liability

4. Remain invested in the market throughout

Example: You bought VTI at $100, now trading at $85 (15% loss). Sell VTI, immediately buy ITOT (different S&P 500 ETF). You realize a $15 loss per share for tax purposes while maintaining market exposure. This $15 loss offsets $15 of gains elsewhere, saving $2.25-7.50 per share in ETF tax (depending on your bracket).

Wash Sale Rule: You cannot buy the “substantially identical” security within 30 days before or after the sale. Buying a different ETF tracking the same index avoids this. Understanding this ETF tax implication rule is critical for successful tax-loss harvesting.

Strategy 3: Holding Period Management

The one-year holding period dividing short-term from long-term ETF tax treatment is exactly 365 days plus one day (366 days total). Strategic timing around this threshold saves massive taxes:

Example: You bought an ETF on March 15, 2024. You want to sell with a $30,000 gain. Selling on March 15, 2025 (exactly 365 days) triggers 37% short-term capital gains tax = $11,100. Selling on March 16, 2025 (366 days) triggers 15% long-term tax = $4,500. Waiting one extra day saves $6,600 in ETF tax.

Always verify exact purchase and sale dates. Even one day matters for ETF tax implications.

Strategy 4: Dividend Reinvestment Tracking

When you reinvest ETF dividends, each reinvestment creates a new tax lot with its own purchase date and cost basis. This creates opportunities for selective tax-lot selling:

Specific Identification Method: When selling ETF shares, specify which tax lots to sell. Sell high-cost-basis shares to minimize capital gains ETF tax. Sell shares held over one year to ensure long-term treatment.

Most brokers default to FIFO (first in, first out), which may not optimize ETF tax implications. Change your default to “specific identification” for maximum control over ETF tax liability.

Strategy 5: Roth Conversion Ladder

If you hold ETFs in Traditional IRA, consider converting some to Roth IRA during low-income years. You pay taxes on the conversion amount but then enjoy tax-free growth forever, eliminating all future ETF tax implications on that money.

Optimal timing: Convert during years when your income drops (sabbatical, between jobs, early retirement before Social Security). Fill up lower tax brackets with conversions, minimizing the tax pain while eliminating future ETF tax drag.

Common ETF Tax Mistakes That Cost Thousands

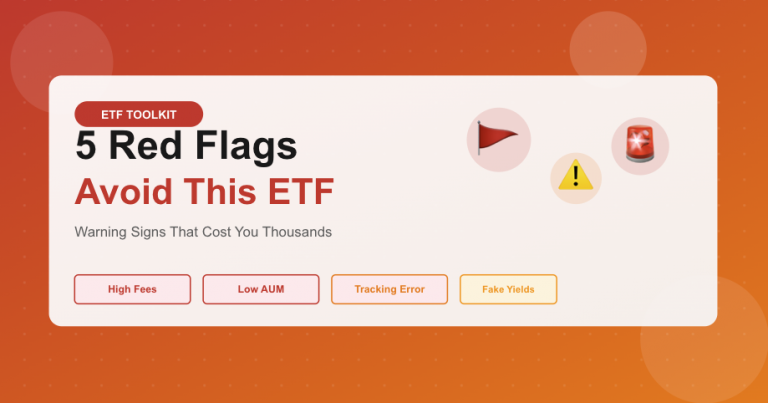

Avoid these catastrophic ETF tax errors:

Mistake #1: Holding Bond ETFs in Taxable Accounts

Bond ETF interest gets taxed as ordinary income annually—up to 37% federal. A bond ETF yielding 4% delivers just 2.52% after-tax in the 37% bracket. Over 30 years on $100,000, this tax inefficiency costs approximately $85,000 compared to holding in an IRA. Never hold bond ETFs in taxable accounts unless absolutely necessary.

Mistake #2: Ignoring Wash Sale Rules

Selling an ETF at a loss, then repurchasing the identical ETF within 30 days disallows the loss. Your tax-loss harvesting fails completely. You thought you’d offset gains, but the IRS disallows the loss, creating an unexpected tax bill. Always buy a different (but similar) ETF to maintain market exposure while preserving the tax loss.

Mistake #3: Frequent Trading in Taxable Accounts

Every profitable trade held under one year triggers 10-37% short-term capital gains tax. Frequent traders in taxable accounts can pay 37% taxes while buy-and-hold investors pay 15%. Over time, this difference destroys wealth. If you must trade frequently, do it in retirement accounts where tax implications are deferred.

Mistake #4: Not Tracking Cost Basis Properly

Losing cost basis records means the IRS assumes $0 basis, making your entire sale proceeds taxable. If you sell $50,000 of ETF shares you bought for $30,000 but can’t prove it, the IRS treats it as a $50,000 gain (not $20,000). This tax nightmare costs $7,500 in unnecessary taxes at 15% rate. Keep meticulous records or ensure your broker tracks basis.

Mistake #5: Selling Winners Before One Year

Selling profitable positions at 364 days triggers maximum short-term capital gains tax. Waiting one more day cuts the tax rate in half for most investors. This impatience costs thousands. Set calendar reminders for the one-year anniversary of every purchase to avoid this ETF tax disaster.

Special ETF Tax Situations

Foreign Tax Credit for International ETFs

International ETFs often face foreign withholding taxes on dividends—typically 10-30% depending on country. However, you can claim a foreign tax credit on your U.S. return, recovering some or all of these withheld taxes. This ETF tax benefit reduces the effective tax burden of international investing.

The foreign tax credit appears on Form 1116 (for credits over $300/$600) or can be claimed directly on Schedule 3. Your ETF will report foreign taxes paid on Form 1099-DIV. Don’t ignore this—it recovers money you’ve already lost to foreign governments.

Qualified Business Income (QBI) and REIT ETFs

REIT dividends may qualify for the 20% QBI deduction under certain conditions. This tax benefit effectively reduces the tax rate on REIT income from 37% to approximately 29.6% for high earners. However, QBI deduction phases out at higher incomes and has complex limitations.

If you hold REIT ETFs in taxable accounts (not recommended), consult a tax professional about QBI eligibility. This deduction can save thousands annually on REIT distributions.

State Tax Considerations

Most states tax capital gains and dividends as ordinary income. However, some states offer preferential treatment:

No State Income Tax (0% ETF Tax):

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming

→ ETF investing is significantly more tax-efficient in these states

No Tax on Interest/Dividends (Partial Benefit):

New Hampshire (being phased out)

→ Dividend-paying ETFs are more tax-efficient

High-tax states (CA: 13.3%, NY: 10.9%, NJ: 10.75%) make ETF tax efficiency even more critical. The combined federal and state tax hit can exceed 50% on short-term gains in these states.

ETF Tax Reporting: What to Expect

Understanding ETF tax reporting helps you prepare for tax season:

Form 1099-DIV: Reports dividends and capital gains distributions from your ETFs. You’ll receive this by January 31. Qualified dividends appear in Box 1b. Ordinary dividends in Box 1a. Capital gains distributions in Box 2a.

Form 1099-B: Reports ETF sales. Shows proceeds, cost basis (if broker tracks it), and whether gains are short-term or long-term. Verify the broker’s cost basis against your records—errors happen frequently.

Form 8949 and Schedule D: You report ETF sales here, calculating capital gains/losses and determining final tax liability.

🚨 Critical Tax Warning:

Brokers sometimes issue corrected 1099 forms in February or March, changing your reported income. Never file your taxes in January using preliminary forms. Wait until mid-February at minimum. Filing early with wrong numbers means filing an amended return—expensive and time-consuming. This tax mistake costs hours of frustration and potential accounting fees.

ETF Tax Efficiency: The Bottom Line

Mastering ETF tax implications delivers three massive benefits:

1. Wealth Preservation: Keeping 85 cents of every dollar (15% long-term tax) instead of 63 cents (37% short-term tax) compounds into hundreds of thousands over decades.

2. Flexibility: Understanding ETF tax rules enables strategic tax-loss harvesting, Roth conversions, and asset location optimization—all legal ways to minimize taxes.

3. Peace of Mind: No surprise tax bills. No panic about capital gains distributions. Just predictable, manageable ETF tax consequences you control.

The investors who master ETF tax implications accumulate significantly more wealth than those who ignore taxes until April 15. Every dollar saved in taxes compounds tax-free forever. That’s true financial leverage.

💰 Optimize Your ETF Taxes

You now understand ETF tax implications that most investors ignore.

Review your portfolio today: Are bond ETFs in taxable accounts? Short-term holdings?

Every tax optimization decision compounds into thousands in wealth preservation.

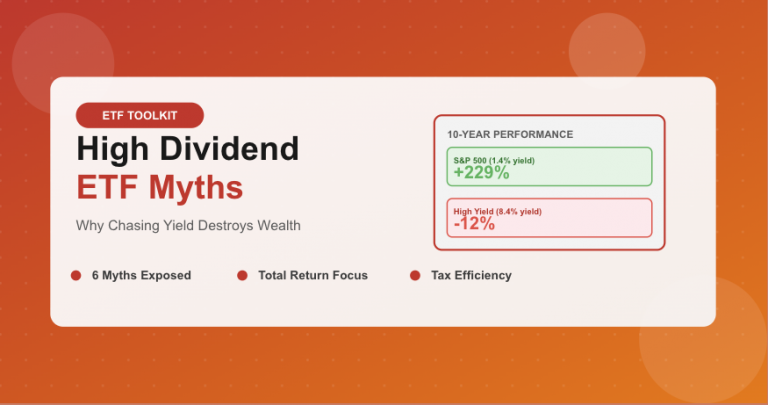

📈 Next in ETF Toolkit Series: Now that you understand tax efficiency, we’ll debunk “High Dividend ETF Myths”—why chasing yield often destroys returns and what dividend investors actually need to know. Don’t miss this yield-chasing reality check!