Finding Your Perfect ETF: Match Your Investment Personality | Investment Series Part 2

Now that you understand what ETFs are, it’s time to find the right one for YOU. Not all ETFs are created equal, and choosing the wrong one can mean the difference between steady growth and disappointing returns. Let’s discover your investment personality and match it with the perfect ETF strategy.

Step 1: Discover Your Investment Personality

Before diving into specific ETFs, you need to understand yourself as an investor. Answer these 5 key questions honestly:

🎯 Investment Personality Quiz

1. What’s your investment timeline?

• Less than 1 year → Ultra-short term

• 1-3 years → Short term

• 3-10 years → Medium term

• 10+ years → Long term

2. How would you react to a 20% portfolio drop?

• Panic and sell immediately → Very conservative

• Feel anxious but hold → Conservative

• Stay calm and wait → Moderate

• Buy more at discount → Aggressive

3. What’s your primary goal?

• Preserve capital → Stability focused

• Generate steady income → Dividend focused

• Grow wealth moderately → Balanced growth

• Maximize returns → Growth focused

4. What percentage of loss can you tolerate in a year?

• 0-5% → Very low risk tolerance

• 5-15% → Low risk tolerance

• 15-25% → Moderate risk tolerance

• 25%+ → High risk tolerance

5. Do you need regular income from investments?

• Yes, I depend on it → Income priority

• Nice to have but not essential → Balanced approach

• No, I can reinvest everything → Growth priority

💡 Key Insight: Most answers pointing to “conservative” or “dividend focused”? You’re a stability investor. Mostly “aggressive” or “growth focused”? You’re a growth investor. Mixed answers? You’re a balanced investor.

Step 2: The 4 Essential ETF Selection Criteria

Once you know your personality, evaluate ETFs using these critical factors:

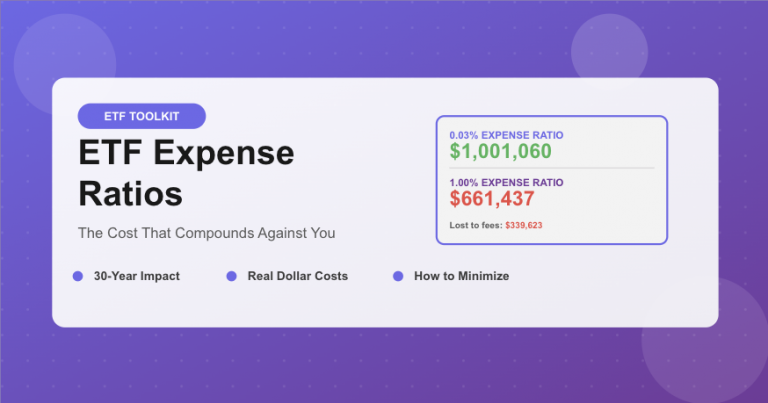

1. Expense Ratio (Total Cost)

This is the annual fee charged by the ETF, expressed as a percentage. Lower is always better for long-term investors.

What to look for:

• Excellent: 0.03% – 0.10%

• Good: 0.10% – 0.30%

• Acceptable: 0.30% – 0.50%

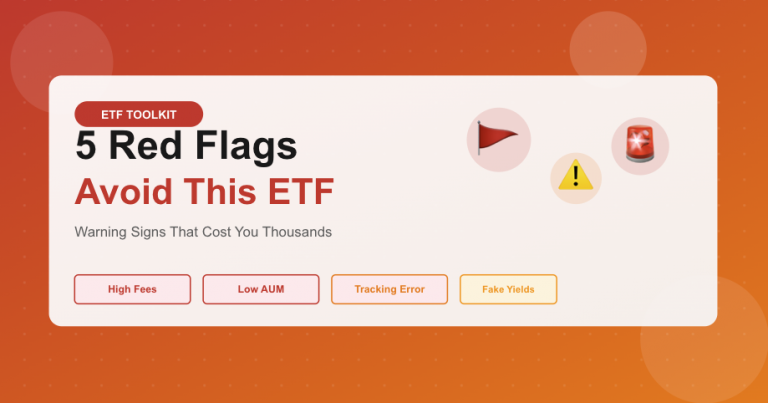

• Avoid: Above 0.50% for passive ETFs

Example: A 0.50% difference on $10,000 invested for 20 years costs you approximately $2,800 in lost returns!

2. Assets Under Management (AUM)

This shows how much money is invested in the ETF. Larger is generally safer.

Why it matters:

• Large AUM ($1B+): Better liquidity, lower closure risk

• Small AUM (Under $50M): Risk of fund closure, wider bid-ask spreads

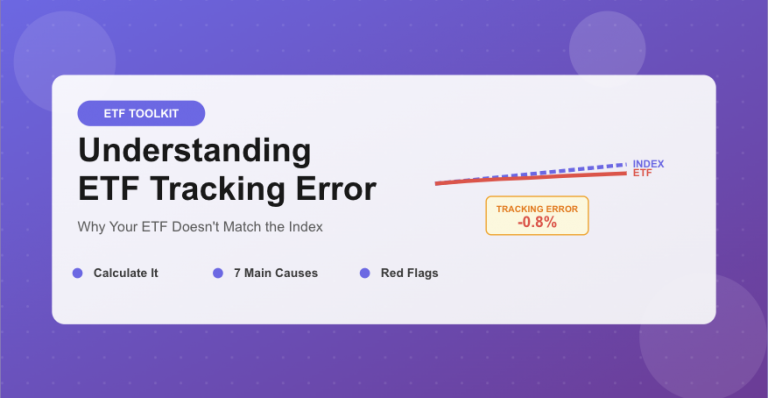

3. Tracking Error

This measures how closely the ETF follows its target index. Lower tracking error means better performance accuracy.

How to check: Compare the ETF’s 1-year return vs. its benchmark index. A difference under 0.20% is excellent.

4. Distribution Policy

Does the ETF pay out dividends or reinvest them automatically?

Distributing ETFs: Pay cash dividends (good for income seekers)

Accumulating ETFs: Automatically reinvest (good for growth seekers)

Step 3: ETF Categories by Investment Style

🚀 Growth-Oriented ETFs

Best for: Long-term investors (10+ years), high risk tolerance, under 40 years old

Key Characteristics:

- Focus on capital appreciation

- Higher volatility (20-30% annual swings)

- Lower dividend yields (0-2%)

- Technology and innovation heavy

Popular Types:

• Nasdaq-100 Trackers: Tech giants like Apple, Microsoft, Nvidia

• S&P 500 Trackers: Broad U.S. market exposure

• Emerging Markets: High-growth developing economies

• Sector ETFs: Technology, healthcare, clean energy

Example Performance (Historical):

S&P 500 ETFs: ~10% average annual return (past 30 years)

Nasdaq-100 ETFs: ~12-15% average annual return (past 20 years)

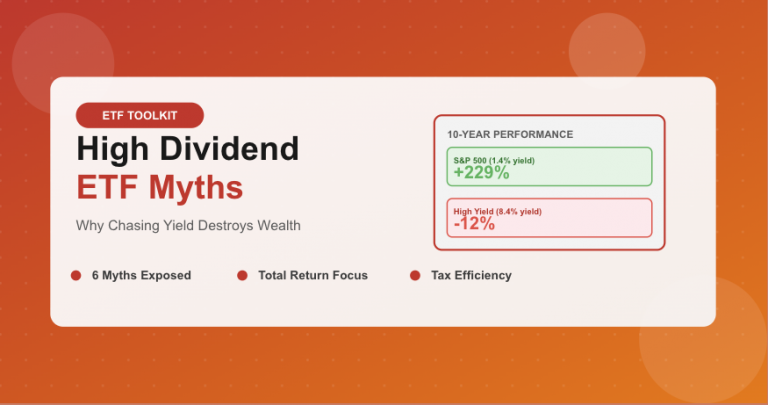

💰 Dividend-Focused ETFs

Best for: Income seekers, retirees, conservative investors, 50+ years old

Key Characteristics:

- Steady cash flow generation

- Lower volatility (10-15% annual swings)

- Higher dividend yields (3-6%)

- Established, profitable companies

Popular Types:

• Dividend Aristocrats: Companies with 25+ years of dividend growth

• High Yield Dividend: Top dividend-paying stocks

• Real Estate (REITs): Property income focused

• Preferred Stock: Fixed-income alternative

Example Performance (Historical):

Dividend Aristocrat ETFs: ~8-9% total return (dividends + growth)

High Yield ETFs: ~6-8% total return with 4-5% dividend yield

⚖️ Balanced ETFs

Best for: Moderate risk tolerance, 5-10 year horizon, balanced investors

Key Characteristics:

- Mix of stocks and bonds

- Moderate volatility (12-18% annual swings)

- Balanced growth and income

- Built-in diversification

Popular Types:

• 60/40 Portfolios: 60% stocks, 40% bonds

• Target-Date Funds: Auto-adjust as you age

• Multi-Asset ETFs: Stocks, bonds, commodities mix

• Dividend + Growth Blend: Best of both worlds

Example Performance (Historical):

Balanced 60/40 ETFs: ~7-8% average annual return

Target-Date Funds: ~6-9% depending on target year

Quick Comparison: Which Style Fits You?

📊 Real Investor Examples

Case 1: Sarah, 28, Software Developer

Profile: High income, 30+ years until retirement, tech-savvy

Choice: 80% S&P 500 ETF + 20% Nasdaq-100 ETF

3-Year Result: 45% total return despite market volatility

Strategy: Monthly automatic investments, never sold during dips

Case 2: Mike, 62, Recently Retired

Profile: Needs $2,000/month income, low risk tolerance

Choice: 70% Dividend Aristocrats ETF + 30% Bond ETF

3-Year Result: 18% total return + $72,000 in dividends received

Strategy: Lives off dividends, rarely touches principal

Case 3: Jennifer, 45, Teacher

Profile: Moderate savings, 15 years to retirement, balanced approach

Choice: 60/40 Target-Date 2040 Fund

3-Year Result: 24% total return, gradually becoming conservative

Strategy: Set-it-and-forget-it, rebalances automatically

Common Mistakes to Avoid

❌ Chasing last year’s winner: Past performance doesn’t guarantee future results

❌ Ignoring expense ratios: High fees destroy long-term returns

❌ Over-diversification: Owning 20+ ETFs creates confusion, not safety

❌ Emotional switching: Constantly changing strategies kills returns

❌ Neglecting rebalancing: Your 60/40 can become 80/20 over time

💡 Pro Tip: Start simple with just 1-3 ETFs. A simple portfolio of one broad market ETF often outperforms complex strategies with dozens of funds. Complexity is the enemy of execution.

🎯 Ready for Your Investment Strategy?

You know your personality. You understand the ETF types.

Now it’s time to learn the most crucial skill: WHEN to buy, WHEN to hold,

and WHY long-term investing crushes short-term trading.

💬 Coming Up Next: Short-term trading vs long-term holding (with actual data), the power of dollar-cost averaging, how to handle market crashes, and the psychology of successful ETF investing. Don’t miss it!