Understanding ETF Tracking Error: Why Your ETF Doesn’t Match the Index Performance

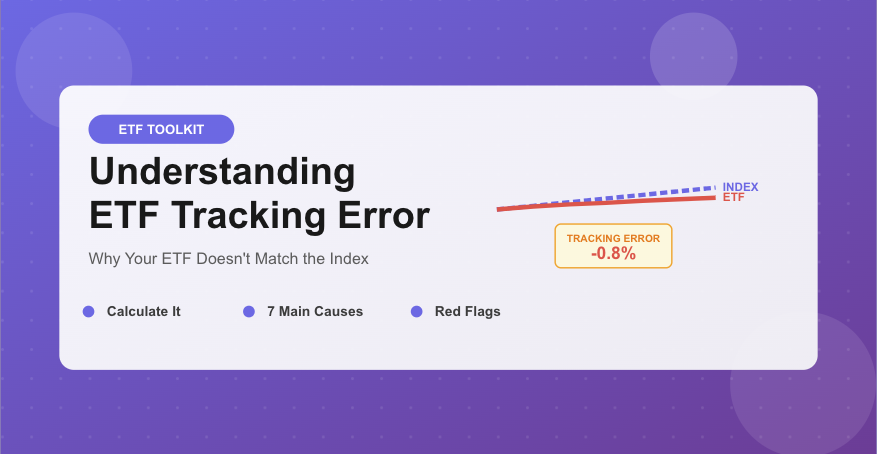

You buy an S&P 500 ETF expecting to match the index’s 26% return, but your ETF only delivers 25.2%. Where did that 0.8% go? Understanding ETF tracking error reveals the hidden performance gap between what you expect and what you actually get—and how to minimize this silent portfolio killer.

What is ETF Tracking Error and Why It Matters

ETF tracking error measures how closely an ETF’s performance follows its benchmark index. When an ETF claims to track the S&P 500, tracking error quantifies how well it actually delivers on that promise. Perfect tracking would mean zero tracking error—the ETF returns exactly match the index returns. In reality, every ETF exhibits some ETF tracking error due to fees, trading costs, and implementation challenges.

Understanding ETF tracking error is critical because it represents the gap between your expectations and reality. You don’t buy an S&P 500 ETF to underperform the S&P 500—you buy it to replicate the index. Every percentage point of tracking error represents money you thought you were making but didn’t. Over decades, significant ETF tracking error compounds into tens of thousands of dollars in lost wealth.

The insidious nature of tracking error: most investors never notice it. They see their ETF gained 25% and feel satisfied, unaware the underlying index gained 26%. That 1% ETF tracking error quietly steals returns year after year, and most investors remain oblivious until someone explains what tracking error actually costs them.

How to Calculate ETF Tracking Error

Calculating ETF tracking error involves comparing the ETF’s returns against its stated benchmark over a specific period. There are two related but distinct concepts when measuring tracking error:

Tracking Difference: The Simple ETF Tracking Error Metric

Tracking difference is the simplest form of ETF tracking error measurement. It’s calculated as:

Tracking Difference = ETF Return – Benchmark Index Return

For example, if an S&P 500 ETF returned 25.2% while the S&P 500 index returned 26.0%, the tracking difference is -0.8%. This negative ETF tracking error indicates underperformance.

Most ETFs display negative tracking difference because expenses and trading costs reduce returns. A well-managed ETF’s tracking difference should approximately equal its expense ratio. If an ETF with a 0.03% expense ratio shows -0.50% tracking difference, that extra -0.47% represents problematic tracking error requiring investigation.

Tracking Error: The Statistical ETF Tracking Measure

The technical definition of ETF tracking error is more sophisticated: it measures the standard deviation of the difference between ETF returns and benchmark returns over time. This statistical tracking error captures return volatility, not just average differences.

A low statistical tracking error means the ETF consistently tracks its benchmark closely. High tracking error means the ETF’s returns diverge unpredictably from the index—sometimes ahead, sometimes behind, but inconsistently. For long-term investors, consistent tracking matters as much as average performance.

💡 Practical Insight on ETF Tracking Error:

Most investors should focus on tracking difference (the simple percentage gap) rather than statistical tracking error. If your S&P 500 ETF consistently underperforms by 0.15% annually and the expense ratio is 0.03%, you know there’s an extra 0.12% of ETF tracking error costing you money. That’s actionable information for evaluating fund quality.

What Causes ETF Tracking Error: The 7 Main Sources

Understanding what creates ETF tracking error helps you evaluate funds intelligently and anticipate which ETFs will exhibit higher tracking error. Here are the seven primary sources of ETF tracking error:

1. Expense Ratios: The Guaranteed ETF Tracking Error

The expense ratio represents the minimum expected ETF tracking error. An ETF charging 0.20% annual fees should underperform its benchmark by at least 0.20%. This is unavoidable tracking error—you’re paying for fund management, so returns must be slightly lower than the index.

When ETF tracking error exactly matches the expense ratio, the fund demonstrates excellent operational efficiency. When tracking error significantly exceeds the expense ratio, problems exist beyond normal costs.

2. Transaction Costs: The Hidden ETF Tracking Error Source

Every time an ETF buys or sells securities, it incurs trading costs: bid-ask spreads, market impact, and commissions. These transaction costs create tracking error beyond the stated expense ratio.

ETFs tracking liquid large-cap indexes minimize this tracking error source—perhaps 0.01-0.03% annually. ETFs tracking illiquid small-cap, emerging market, or bond indexes face much higher transaction costs, potentially adding 0.10-0.30% of additional ETF tracking error.

3. Cash Drag: The Liquidity ETF Tracking Error

ETFs typically hold 1-3% of assets in cash to handle daily redemptions and purchases. This cash position earns minimal returns compared to stocks, creating tracking error. In rising markets, cash drag causes underperformance. In falling markets, cash provides a small cushion, reducing ETF tracking error.

The cash drag tracking error varies by market conditions. In a year where the S&P 500 gains 25% and cash earns 5%, that 2% cash position costs approximately 0.40% of performance (2% × 20% opportunity cost). That’s significant ETF tracking error from a seemingly small cash allocation.

4. Sampling vs Full Replication: The Strategy ETF Tracking Error

Index replication strategy dramatically affects tracking error:

Full Replication: The ETF owns every security in the index at the exact weights. This minimizes tracking error but becomes impractical for indexes with 1,000+ holdings or illiquid securities.

Sampling: The ETF owns a representative subset of index holdings. This reduces transaction costs but increases tracking error because the sample might not perfectly represent the full index.

Large-cap ETFs can use full replication, achieving minimal tracking error. Small-cap and international ETFs often must sample, accepting higher ETF tracking error as a necessary tradeoff for cost control.

📊 Real ETF Tracking Error Example: VTI vs VXUS

VTI (Vanguard Total Stock Market ETF):

• Tracks: CRSP US Total Market Index (4,000+ stocks)

• Uses: Sampling (holds ~3,800 of 4,000+ stocks)

• Expense ratio: 0.03%

• Historical tracking difference: -0.04% to -0.06% annually

• ETF tracking error analysis: Excellent – barely exceeds expense ratio

VXUS (Vanguard Total International Stock ETF):

• Tracks: FTSE Global All Cap ex US Index (8,000+ stocks)

• Uses: Sampling (holds ~7,900 of 8,000+ stocks)

• Expense ratio: 0.08%

• Historical tracking difference: -0.12% to -0.18% annually

• ETF tracking error analysis: Good – higher due to international complexity

VXUS exhibits higher tracking error not due to poor management but because international markets involve higher trading costs, currency conversions, and withholding taxes. This demonstrates how ETF tracking error expectations should adjust by asset class.

5. Dividend Timing: The Reinvestment ETF Tracking Error

Index calculations assume instantaneous dividend reinvestment. Real ETFs receive dividends on specific dates and typically hold them temporarily before distributing to shareholders. This timing mismatch creates tracking error.

For high-dividend ETFs, dividend timing tracking error can be significant—potentially 0.10-0.20% annually. The ETF earns minimal return on cash dividends awaiting distribution while the index calculation assumes full immediate reinvestment at market prices.

6. Index Rebalancing and Reconstitution: The Trading ETF Tracking Error

When indexes rebalance (quarterly or annually) or reconstitute (adding/removing securities), ETFs must trade to match. This creates tracking error from:

Front-running: Other traders anticipate index changes and move prices before the ETF can execute. This increases transaction costs and worsens ETF tracking error.

Market impact: Large ETFs moving billions of dollars during rebalancing affect security prices. The ETF pays the market impact cost, creating tracking error.

Timing differences: The index calculation assumes trades at the closing price on rebalance date. Real-world execution occurs throughout the day at varying prices, generating ETF tracking error.

7. Securities Lending: The Double-Edged ETF Tracking Error Factor

Many ETFs lend securities to short sellers for fees. This securities lending revenue can actually reduce tracking error by offsetting expenses and transaction costs. However, poorly managed lending programs create ETF tracking error through counterparty risk, operational inefficiencies, and recall costs.

Well-run securities lending adds 0.02-0.10% of performance annually, reducing net tracking error. Poorly managed lending might add nothing while introducing operational risks that increase tracking error unpredictably.

What’s Acceptable ETF Tracking Error? Category Benchmarks

Not all ETF tracking error is created equal. Acceptable tracking error varies dramatically by asset class, market liquidity, and index complexity. Here’s what to expect:

These ETF tracking error benchmarks represent tracking difference (ETF return minus index return), not statistical tracking error. Use these thresholds to evaluate whether an ETF demonstrates acceptable performance versus its stated benchmark.

How to Check ETF Tracking Error: Step-by-Step

Don’t rely on marketing claims about low tracking error. Verify actual ETF tracking error yourself using this systematic process:

Step 1: Identify the Benchmark Index

Find the exact index the ETF tracks. Look in the fund prospectus or fact sheet. The benchmark must be specific—”S&P 500 Total Return” is different from “S&P 500 Price Return.”

Step 2: Gather Return Data

Collect 1-year, 3-year, and 5-year returns for both the ETF and its benchmark. Use the ETF provider’s website for ETF returns and the index provider’s website (S&P, FTSE, MSCI) for benchmark returns.

Step 3: Calculate Tracking Difference

For each time period, subtract the benchmark return from the ETF return. This gives you the tracking difference for each timeframe.

Example:

ETF 5-year return: 85.2%

Benchmark 5-year return: 86.0%

Tracking difference = 85.2% – 86.0% = -0.8%

Step 4: Annualize the Tracking Difference

Divide the total tracking difference by the number of years to get annual average tracking error.

-0.8% ÷ 5 years = -0.16% annual tracking error

Step 5: Compare to Expense Ratio

Check if the tracking error approximately equals the expense ratio plus expected transaction costs for that asset class. If tracking error significantly exceeds this, the ETF has execution problems.

Step 6: Evaluate Consistency

Compare tracking error across 1-year, 3-year, and 5-year periods. Consistent tracking error around the same level indicates stable management. Wildly varying ETF tracking error suggests operational inconsistency.

When Negative ETF Tracking Error Becomes a Red Flag

Some ETF tracking error is expected and acceptable. But excessive tracking error signals serious problems requiring immediate attention:

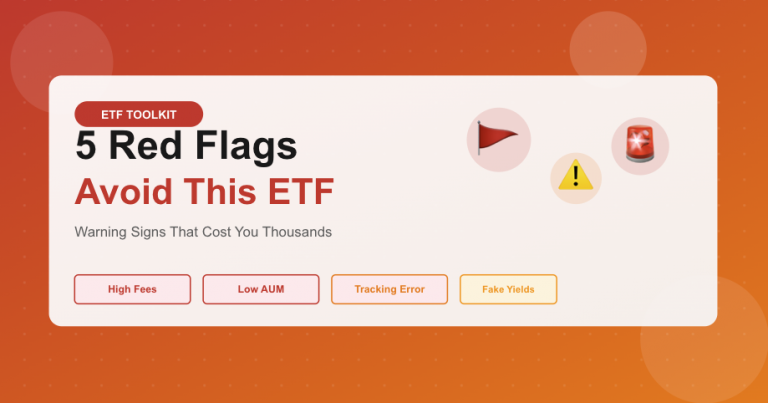

Red Flag #1: Tracking Error Exceeds Expense Ratio by 0.30%+

If an ETF with a 0.10% expense ratio consistently shows -0.50% tracking error, that extra -0.40% represents poor execution, excessive trading costs, or operational inefficiency. This ETF tracking error red flag means you’re losing 0.40% annually to avoidable problems.

Red Flag #2: Increasing Tracking Error Over Time

When tracking error worsens from -0.10% to -0.30% to -0.50% over consecutive years, the fund management is deteriorating. Growing ETF tracking error suggests problems with fund size, management changes, or operational challenges.

Red Flag #3: Higher Tracking Error Than Peer Funds

Compare tracking error against competitor ETFs tracking the same or similar indexes. If one S&P 500 ETF shows -0.05% tracking error while another shows -0.40%, the second fund has obvious execution problems. Always benchmark ETF tracking error against peers.

🚨 Critical Warning on ETF Tracking Error:

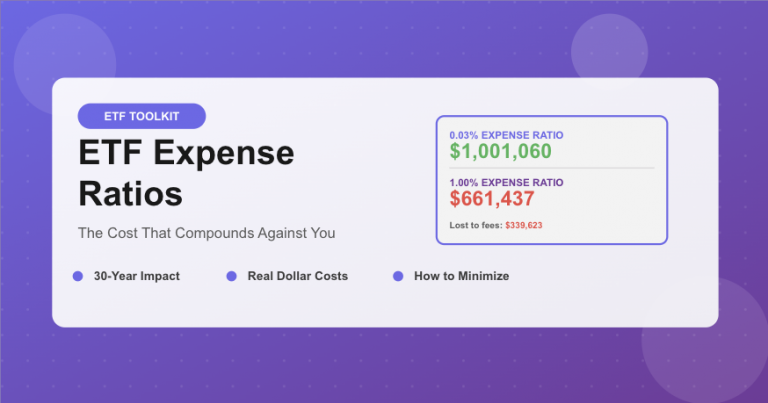

Excessive ETF tracking error compounds like expense ratios. An ETF with -0.50% annual tracking error costs you $50 per year on every $10,000 invested. Over 30 years, that’s approximately $45,000 in lost wealth on a $100,000 portfolio. High tracking error isn’t a technical inconvenience—it’s a retirement-destroying wealth leak.

Can ETF Tracking Error Ever Be Positive?

Occasionally, ETFs outperform their benchmark, creating positive tracking error. How does this happen?

Securities Lending Revenue: Successful securities lending programs generate fees exceeding expenses and transaction costs. This can create positive tracking error of 0.02-0.10% annually. Some Vanguard and BlackRock ETFs consistently exhibit small positive tracking error through excellent securities lending.

Dividend Timing Luck: If the ETF holds dividend cash during a market decline, that cash position inadvertently creates positive tracking error by avoiding losses. This is random luck, not skill, and reverses in rising markets.

Sampling Benefits: Occasionally, the sampled securities outperform the full index. This creates temporary positive ETF tracking error but shouldn’t be expected consistently.

While positive tracking error seems desirable, it’s not sustainable or predictable. Focus on consistently low negative tracking error close to the expense ratio—that indicates excellent fund management.

How to Minimize ETF Tracking Error Impact

You can’t eliminate ETF tracking error, but you can minimize its impact on your portfolio:

Strategy 1: Choose Low-Turnover Indexes

ETFs tracking indexes with infrequent rebalancing (annually vs quarterly) exhibit lower tracking error because they trade less frequently. Indexes with stable methodologies create fewer transaction costs and lower ETF tracking error.

Strategy 2: Favor Liquid Markets

Large-cap U.S. equity ETFs have the lowest tracking error because the underlying markets are highly liquid. Small-cap, international, and bond ETFs face higher transaction costs that increase ETF tracking error. Accept higher tracking error in these categories as unavoidable.

Strategy 3: Select Large, Established ETFs

Larger ETFs benefit from economies of scale: lower per-dollar trading costs, better securities lending terms, and more efficient operations. This translates to lower tracking error. An S&P 500 ETF with $300 billion in assets will likely have lower tracking error than a $50 million competitor.

Strategy 4: Compare Tracking Error Annually

Review your ETFs’ tracking error once per year. If you discover a competitor with significantly lower tracking error (0.20%+ difference), consider switching. That seemingly small ETF tracking error difference compounds to $50,000+ over a 30-year investment horizon.

Strategy 5: Accept Tracking Error as a Cost

Some tracking error is unavoidable. Don’t chase perfect tracking at the expense of other factors like liquidity, tax efficiency, or fund stability. A well-managed ETF with -0.15% tracking error beats a problematic fund with -0.10% tracking error if the problematic fund faces closure risk or operational issues.

ETF Tracking Error vs Tracking Difference: What’s the Difference?

Many investors confuse these terms. Here’s the distinction:

Tracking Difference (Simple): The straightforward percentage gap between ETF return and index return. If the S&P 500 returned 10% and your ETF returned 9.85%, tracking difference is -0.15%. This is what most investors should monitor for ETF tracking error evaluation.

Tracking Error (Statistical): The standard deviation of return differences over time. This measures consistency, not just average difference. A fund might have -0.15% average tracking difference but 0.50% tracking error if returns vary wildly relative to the benchmark each month.

For practical ETF tracking error evaluation, focus on tracking difference across 1-year, 3-year, and 5-year periods. Statistical tracking error matters more for institutional investors and fund managers obsessing over minute performance variations.

🎯 Master Tracking Error Analysis

You now understand how ETF tracking error silently erodes returns.

Check your current ETFs’ tracking difference this week. Compare against benchmarks.

If you find tracking error exceeding expense ratio by 0.30%, consider switching funds.

📈 Next in ETF Toolkit Series: Now that you can evaluate tracking error, we’ll tackle “ETF Tax Implications: What Your Broker Won’t Tell You”—the tax strategies that legally save thousands annually. Essential knowledge for taxable account investors!