What is an ETF? The Complete Beginner’s Guide | Investment Series Part 1

Want to start investing but overwhelmed by which stocks to choose? ETFs are investment products that even beginner investors can easily start with. This 3-part series will guide you from ETF basics to practical investing strategies.

What Exactly is an ETF?

An ETF (Exchange Traded Fund) is an investment product that tracks a specific index and can be bought and sold on stock exchanges just like individual stocks. Simply put, think of it as “a fund that trades like a stock”.

For example, buying the “SPY” ETF gives you the effect of investing in all 500 companies in the S&P 500 at once. You don’t need to individually purchase Apple, Microsoft, Amazon, etc. – one product creates an entire portfolio.

How Do ETFs Work?

ETFs operate through index tracking (indexing). Rather than a fund manager selecting stocks, the ETF automatically follows the composition and weightings of a specific index.

💡 Key Point: When you buy an S&P 500 ETF, you automatically get diversified exposure to 500 leading U.S. companies including Apple, Microsoft, and Amazon. No need to worry about picking individual stocks!

Pros and Cons of ETFs

Advantages

- ✓Diversification with small amounts

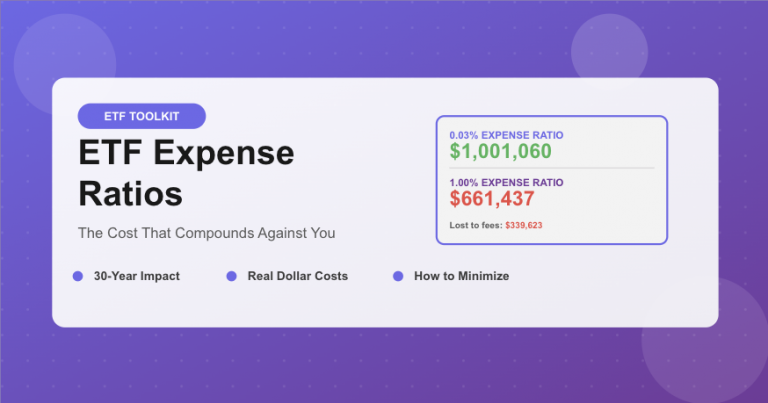

- ✓Low expense ratios (0.03-0.5%)

- ✓Real-time trading capability

- ✓Transparent holdings disclosure

- ✓No stock selection stress

Disadvantages

- ✗Returns capped at index performance

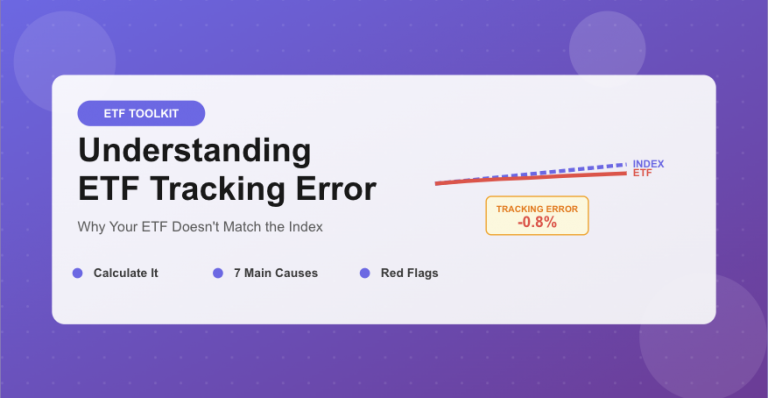

- ✗Potential tracking errors

- ✗Trading commissions apply

- ✗Cannot exclude specific holdings

Individual Stocks vs ETFs: What’s the Difference?

| Comparison | Individual Stocks | ETFs |

|---|---|---|

| Investment Target | Single company | Multiple companies bundled |

| Risk Level | High (concentrated) | Lower (diversified) |

| Return Potential | High returns possible | Market average returns |

| Knowledge Required | Company analysis essential | Minimal knowledge needed |

| Management Time | High (continuous monitoring) | Low (long-term hold) |

📊 Real-World Example

Investor A’s Choice: Buys 1 share of Apple stock ($180)

→ Returns depend solely on Apple’s performance

Investor B’s Choice: Buys 1 share of SPY ETF ($450)

→ Returns based on the average performance of 500 companies

With the same dollar amount, Investor B gets exposure to 500 companies. If Apple underperforms, other strong performers can offset the losses.

Who Should Invest in ETFs?

ETFs are ideal for:

✓ Beginner investors who struggle with stock selection

✓ Those wanting diversification with small amounts

✓ Investors planning for the long term

✓ Busy professionals with limited time

✓ Those seeking stable market-average returns

Individual stocks may be better for:

✓ Investors confident in company analysis

✓ Those pursuing above-market returns

✓ Active traders who enjoy frequent trading

✓ Investors with strong conviction in specific sectors

🎯 Which ETF is Right for You?

Different investment styles require different ETF products.

In the next episode, we’ll help you identify your investment personality

and show you how to choose the perfect ETF match.

💬 Coming Up Next: ETF selection criteria based on investment style (aggressive vs conservative), how to check expense ratios, why assets under management matters, and more essential tips for real-world investing!